Balancer partners with Gauntlet to introduce Dynamic-fee pools so the V2 liquidity providers will be able to enjoy the improved returns as we are reading more in our latest cryptocurrency news.

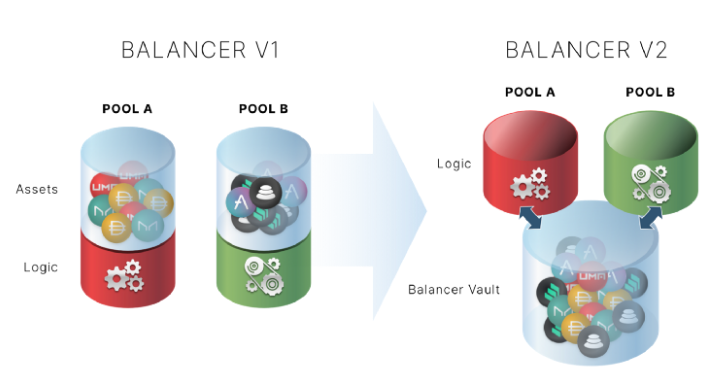

The token protocol enabling automatic market making Balancer partners with Gauntlet, a blockchain-based simulation platform for creating financial models, and the new collaboration aims to enhance returns for the v2 liquidity providers while still keeping the funds non-custodial. Balancer announced the new partnership with Gauntlet while aiming to maximize returns for Liquidity Providers on the announced Balancer V2 platform.

After the integration LPs will have the “long-awaited dynamic fee AMM pools” that are available for their disposal and the statement also promised that the upgrade won’t cost the users at all. Furthermore, Gauntlet will not be able to access or move the funds at any time which means that they will be non-custodial. A simulation platform shows that Gauntlet uses “Battle-tested” techniques from the algorithmic trading industry to help protocols manage risks, rewards, and capital efficiency. The partnership with balancer will enable Gauntlet to make protocol parameter optimizations like trading fees.

Also, the project promised to continue improving the simulation model on the quest to become a core component of Balancer that will launch with “few dozen “Gauntlet powered pools.” COO John Morrow commented:

“Balancer’s vision for their V2 pools is perfectly suited for our simulation platform. Dynamic fees allow Balancer to leverage our off-chain automation to improve on-chain LP returns. We are looking forward to launch, but we are even more excited for what comes after – our optimization platform gets smarter as we incorporate more live data.”

The PR touched upon the difficulty of attracting pool liquidity as the Defi space became hyper-competitive. But, Fernando Martinelli who is the CEO of Balancer said that the partnership with Gauntlet will place the team a few steps further in the race. He believes that the “fixed-fee pools won’t be able to compete with dynamic-fee pools just like taxis can’t compete with ride-sharing apps.

buy premarin online http://www.suncoastseminars.com/assets/new/premarin.html no prescription

It is better for all stakeholders for fees to constantly adapt to the market conditions.”

The statement noted that the addition of new types of AMM on Balancer V2 will bring even more opportunities for teams and protocols to employ the protocol by exploring pool parameters and real-time optimization.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post