Balancer and Aave have continued their collaboration yet again in order to launch the boosted pools for improving Defi yields as we can see today in our cryptocurrency news.

Balancer and Aave announced the launch of Boosted Pools. Aave is the most popular lending and borrowing protocol with more than $13.4 billion in total assets. Aave’s lenders earn interest by locking their crypto in liquidity pools and borrowers who can take out loans by providing crypto as collateral. The project is responsible for developing flash loans and Balancer to do so doubles as a decentralized exchange and crypto index fund provider that allows users to earn fees for creating attractive pools of liquidity and now the two partnered to lift the yields on both projects.

About 10% of the liquidity deposited into automated market makers like Balancer is utilized by traders because the trade sizes are smaller than the money deposited in the pool to avoid slippage. Thanks to Balancer’s new Boosted pools platform, the users can deposit a given percentage of unused liqudity in AMM pools in the lending protocols like Aave where it earns more yields. To increase the capital efficiency, the interest-bearing token on the ETH network can be redeemed for DAI at 1:1 exchange rate while the aDAI token is minted on deposit and burned once it is redeemed but the wrapping token is a complicated process that can be very expensive during a trade.

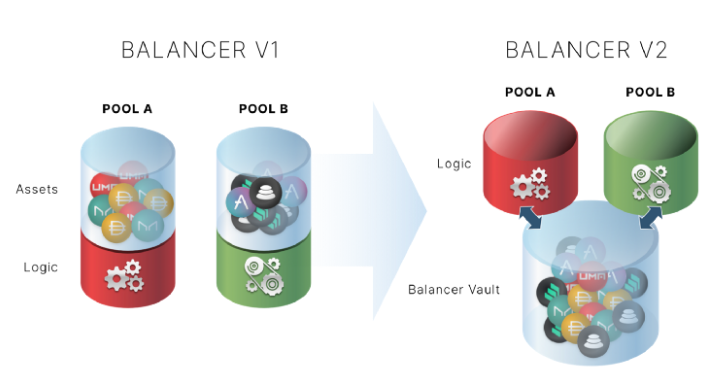

Aave boosted pools solve the problem by outsourcing the wrapping and unwrapping processes for the arbitrageurs that are incentives to do it. Balancer announced their collaboration back in February when the CEO and founder Fernando Martinelli wrote a blog post about the upcoming Balancer V2 Asset Manager. Martinelli said in a statement that the collab between Balancer and Aave is a natural fit that will enhance both ecosystems. There are various levels of Boosted Pool innovations that lead to better results, deeper liquidity, and efficient integrations for higher yields.

As recently reported, The popular Defi project Balancer Protocol joined the fight against the high fees by launching on the Layer 2 solution and with the transition from Ethereum, Balancer announced new token incentives that came into effect a few days ago in June. Balancer launched on Polygon and promised to “turn the concept of an index fund on its head.” Balancer is a DeFi project that enables users to collect fees from the traders instead of the portfolio managers. The protocol announced the latest development in a press release. The statement reads that Balancer launched support on the Layer 2 solution Polygon to reduce the gas costs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post