AVAX traders await a new high with the Avalanche dapp use slowing down but the price already posted a multi-month high which signals that the downtrend is over so let’s take a closer look at today’s latest altcoin news.

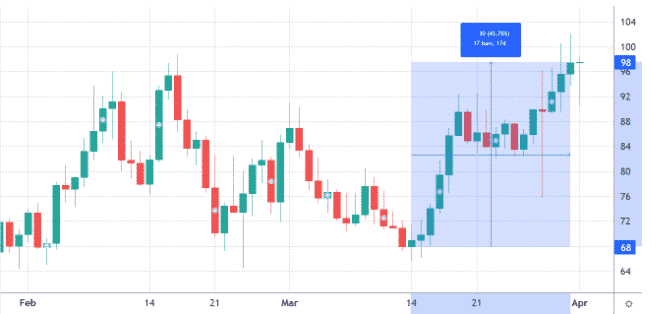

Avalanche jumped 43.8% between March 14 and March 31 to a daily close of $97.50 which is the highest level since the beginning of the year. This layer-1 scaling solution uses a PoS model and amassed $9 billion in TVL deposited ont eh smart contracts network. Some analysts attribute the rally to the Avalanche incentive program to accelerate the adoption of the subnets that were announced recently. According to the Avalanche Foundation, the subnets enable functions that are only possible with network-level controls and open experimentation.

The program will allocate up to four million AVAX worth $340 million to fund the decentralized apps focused on gaming and NFTs. Wes Cowan who is the managing director of Valkyrie Investments added that the Avalanche subnet with KYC infrastrcuture will be a huge step ahead for the institutional adoption. The AVAX traders await a new high as the price is still 33% below its $147 and the token holds a $26.3 billion market cap. The market cap of Terra stands at $38.1 billion while SOL has a billion total value.

buy furosemide online https://cleanandclearadvantagerecovery.com/wp-content/themes/twentytwentyone/inc/new/furosemide.html no prescription

Avalanche is also EVM compatible and doesn’t have expensive transaction fees with the network congestion impacting the Ethereum network.

Avalanche’s primary Dapp metric showed some weakness in March after the network’s TVL dropped below 94 million AVAX. The charts show how Avalanche’s Dapp deposits hit 132 million AVAX on March 14 but then declined to the lowest level since January 3. in dollar terms, the current $9 billion TVL marks a 24% drop from the $12.2 billion from December high in 2021. Terra’s TVL increased by 116% between January and March 2022 and reached $19.8 billion while Waves’ smart contract deposit increased from $730 million to $4.5 billion at the same time.

To confirm whether the TVL drop in Avalanche is worrisome, one should analyze the Dapp usage metrics since some dapps like games and collectibles don’t require larger deposits so the TVL metric is irrelevant to the cases. The number of Avalanche network addresses interacting with Dapps dropped by 16% versus the previous month and the Solana network faced a 6% user increase while ETH Dropped by 11%.

Even though Avalanche’s TVL was hit with the most comapred to other smart contract platforms, there’s solid network usage in the DEFI segment. The data suggest that Avalanche is losing the ground against other chains but given that AVAX rallied 43% in the past 17 days, some holders can feel uncomfortable if the decentralzied application network posts a slow TVL.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post