AVAX and LUNA rally over the past week while both Bitcoin and Ethereum slipped as we can see in our latest altcoin news and analysis.

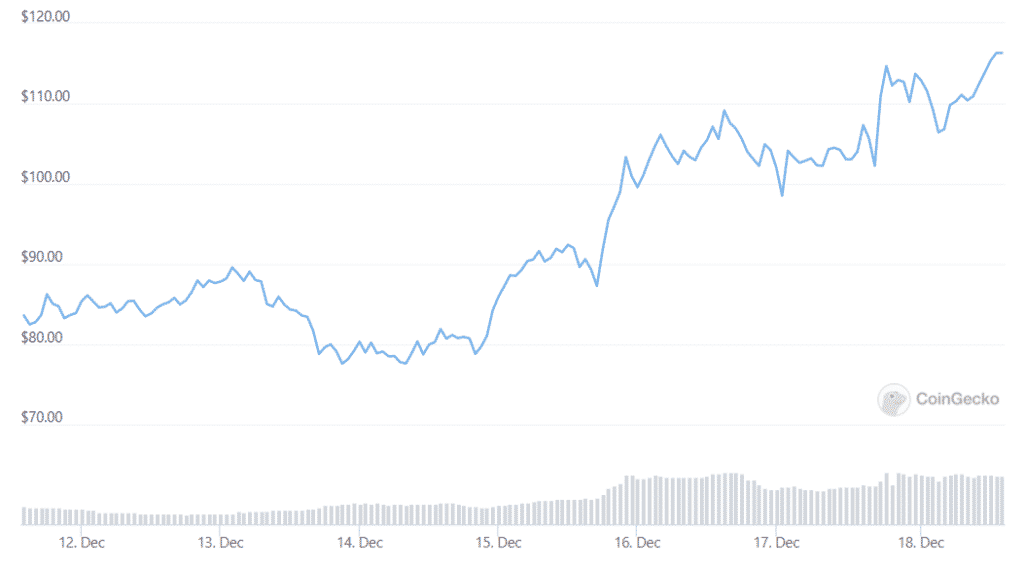

Most of the world’s leading cryptocurrencies were down for the week including top coins Bitcoin and Ethereum but only a few managed to weather the pullback. AVAX and LUNA had some impressive rallies of 40% and 14% respectively. AVAX was worth just $10 less than six months ago and then exploded in price to become the number 9 cryptocurrency by market cap. Avax’s rally is down to the growing institutional adoption as Circle as the most popular financial services company announced it will bring its USDC stablecoin to the Avalanche blockchain.

Two days later, more big news arrived when BitGo said it will support AVAX. The announcement confirmed that Bitstamp and Bitbuy will list AVAX on their exchanges in 2022. LUNA’s rise also was noticeable on the wider market trend. LUNA’s progenitor Terra mints stablecoins pegged to various currencies and TerraUSD is one of the most successful which is poised to flip DAI as the fourth biggest stablecoin by market cap. The UST price is pegged to the dollar via LUNA as an ingenious mechanism where every UST created, a dollar of LUNA has to be burned. The UST market cap is up by 40% since last month.

Dogecoin had a great week despite the slight increase in value of around 3% over the past week to $0.173 cents. The meme coin increased by 20% after Tesla CEO Elon Musk announced that the company will start accepting DOGE for merchandise payments. The market leaders Bitcoin and Ethereum on the other hand showed slower price performances. BTC got down by 3.2% in the past week to $46,820 and Ethereum did a little better but still got down 2.2% over the same timeframe. It now trades at $3947 at the time of writing.

Bitcoin has a market cap of 21 million which many investors argue is the same as digital gold. This week, the amount of BTC mined from the total supply reached 90% but don’t expect the remaining coins to be mined anytime soon. The deputy bank governor John Cunliffe said:

“The point, I think, at which one worries is when it becomes integrated into the financial system when a big price correction could really affect other markets and affect established financial market players […] It’s not there yet, but it takes time to design standards and regulations.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post