Avalanche’s AVAX hits weekly high as the Defi activity has been booming recently as we can see further in today’s latest altcoin news.

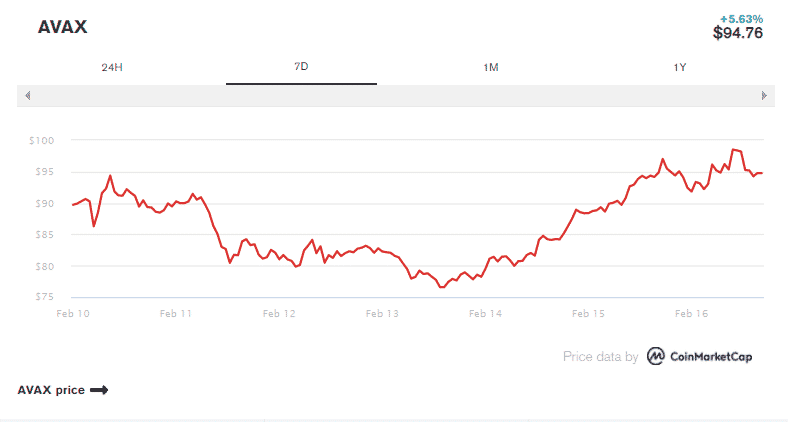

Avalanche’s AVAX hit a weekly high of over $97 as the DEFI activity surged throughout following the late-January hype. The native token for Avalanche is a fast alternative to the leading smart contract platform Ethereum which increased by 11% to hit a weekly high of $97 as of early morning. AVA has since retraced and it is now tradign hands at under $95 as per the data by CoinmarketCap. Despite the uptick, the token is still down by 35% from its all-time high of $146.22 set back in November 2021. Led by former Cornell professor Emin Gun Sirer, Avalanche launched two years ago and was pitched s the more efficient and cheaper alternative to Etheruem.

It allows for most of the same features as Ethereum, including decentralized finance projects and NFTs but since then, the network emerged as one of the top networks for DEFI activity in particular. By total value locked, the general metric for measuring how much money is flowing around in the protocol, Avalanche is now the fourth-largest with $11 billion. Ethereum leads the market now with a whopping $127.7 billion followed by Terra with $16.1 billion and BNB chain with $13.1 billion. The entire Defi market across all chains is now set at $211.18 billion according to DeFi Lama.

The biggest Defi projects on Avalanche include money market Aave, DEX Trader Joe, and the Avalanche-native lending protocol called Benqi. Each project increased its TVL over the past 24 hours by 4.3%, 6.5%, and 4.5%. despite the high Avalanche throughput, the structure is still not immune to congestion and rising fees. The data from SnowTrace shows that the cost of doing business on Avalanche ebbed and flowed as per the increased activity.

Like Ethereum’s layer 2 solutions, Avalanche has its own scaling solution dubbed Subnets to solve the issues emerging. Subnets allow individual projects like Trader Joe and Aave to leverage individual chains which are connected to the Avalanche mainnet but do not take up space on the mainnet. The recent testnet versions of the technology showed how Subnets will work for an NFT marketplace as a native DEX and a crypto game called DArk Forest. Though there is not really a firm deadline for when Subnets will launch, the investors signaled they’re invested in the Avalanche future.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post