The analysts believe the market sell-off is poised to continue and BTC might not return to its green pastures anytime soon so let’s have a closer look at today’s latest bitcoin news.

Analysts claim we haven’t reached the bottom yet and analysts believe the market sell-off will go on. The Huobi Research Institute analysts issued a report titled “Is Another Black May Coming.” Barry Jiang and Hanson Chan wrote that when it comes to BTC, the market bottom has yet to come and the value investors should hold off on the buying process. Huobi’s reasoning came from the argument that the market bottom for BTC can be determined by examining the Net Unrealised Profit/Loss percentage which is quite different from the BTC marekt cap and the realized cap divided by the market cap.

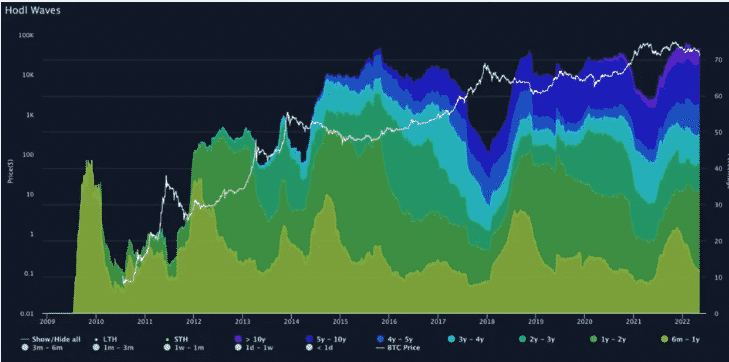

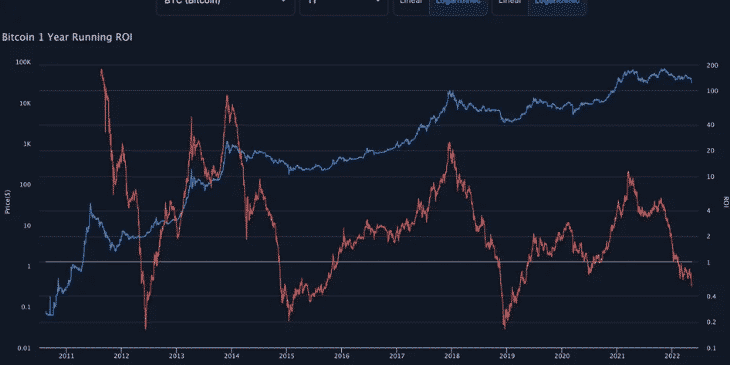

Bitcoin’s realized cap represents the realized value of the coins in the network based on the price at which the output of the unspent transaction was moved last and the realized caps don’t factor in lost or dormant coins. The NUPL has five different classifications: euphoria/greed, belief and denial, optimism and anxiety, hope and fear, and at last capitulation. The capitulation phase is when the price is at its lowest and this is the best time for the buyers to jump in. Based on the BTC NUPL chat, the asset is now in the fear classification and therefore hasn’t reached its bottom price for the current cycle. Market analyst Yuya Hasegawa from Bitbank added:

“From the previous two capitulation phases, we can see that the price dropped from about 40-50% after NUPL turned orange [to Hope/Fear]. So, if the pattern replicates itself, the current bitcoin price could go as low as about $15k. This is somewhat in line with my technical analysis published on Monday (although my price target is a little lower: $12.2k).”

The crypto analyst Benjamin Cowen said that there’s more potential downside. The public interest in crypto seems to be on the decline for now as the data from Social lade shows that the top crypto YOuTube channels are also losing viewers but regardless of where the retail investors stand on crypto, there are analysts who think that on-chain metrics like NUPL are not useful in today’s climate. The head of research at Arcane Research Bendik Norheim Schei added:

“To be honest, I find on-chain metrics pretty useless in the current market, as Bitcoin is clearly tightly connected to the stock market during this fearful market. The correlation with Nasdaq is at an all-time high, and investors are putting Bitcoin in the same basket as risky tech stocks.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post