Ampleforth’s AMPL extends yield farming incentives on Uniswap and the new liquidity incentive could send AMPL to the moon again as we are reading more in our altcoin news today.

In a boost to AMPL farmer, the foundation announced a fresh yield farming scheme that is scheduled to go live next week. The first incentive caused a huge rise in AMPL’s valuation and this one could to the same. Ampleforth’s Geyser and Beehive incentives will incentivize AMPL liquidity on Uniswap that will continue until early December as the project announced a day ago.

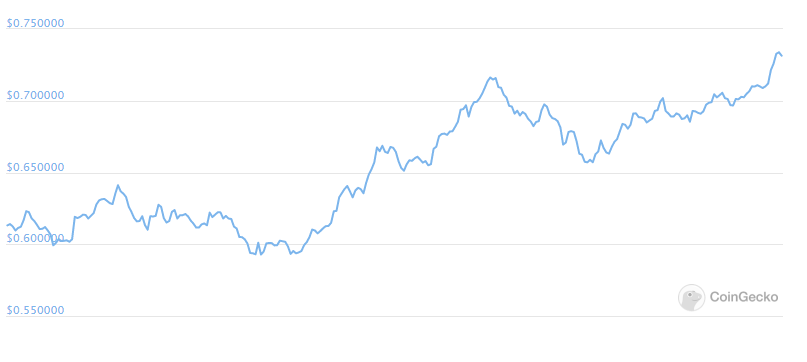

Beehive 2.0 will start on September 10 for 90 days and one percent of AMPL’s supply or 4.95 million tokens have been therefore allocated by the Ampleforth Foundation. When the initial liquidity mining program started in June, it caused a rush of demand for the token and since then the market cap expanded from $21 million to $658 million.

Liquidity mining incentives for Ampleforth have increased from 12.47% of the supply to 23.47% of the total supply. This move is a response to the criticism that the project received for what some others claimed to be an unfair token distribution. AMPL extends its yield farming incentives and the newly announced decision to build financial infrastructure will support elastic tokens such as this one. The automated market maker derivatives platform and money market are in preparation as well. The remaining funds set aside for incentives will be directed to the building liquidity on each of the platforms.

Due to Ampleforth’s rebasing system, it means that everyone that bought AMPL a month ago got a 5000% return on their investment. Some even believe that the asset has plenty of room to go up. Ampleforth is not an average stablecoin as its protocol uses a rebasing system that changes the circulating supply every day in both directions to try and stabilize the price around the dollar, as per the website’s explanations:

“The AMPL protocol automatically adjusts supply in response to demand. When price is high, wallet balances increase. When price is low, wallet balances decrease.”

After spiking at the end of July, Ethereum’s Ampleforth suffered a huge correction. Since its previous highs, the price of the coin dropped around 70 percent and its market cap collapsed by more than 50%

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post