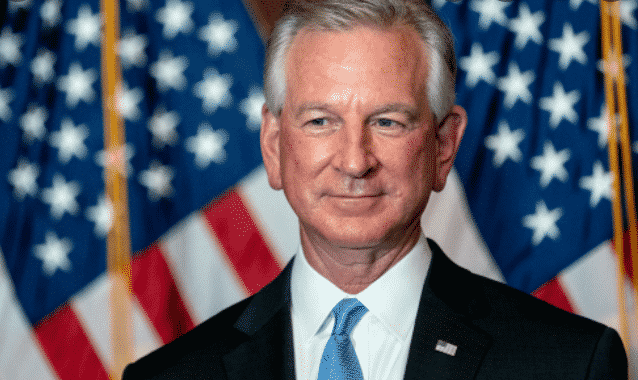

Alabama Senator Tommy Tuberville introduced a new bill that can pave the way for crypto assets to get included in 401K retirement plans so let’s find out more today in our latest cryptocurrency news.

The Alabama Senator believes the government should not limit these types of assets which people can select for their retirement plans:

“The federal government has no business interfering with the ability of American workers to invest their 401(k) plan savings as they see fit.”

The US Department of Labor released regulatory guidance in an attempt to ban 401K accounts from investing in crypto-assets and signed out the speciifc asset class. The 401K is an employer-sponsored defined contribution pension plan and previously, it allowed participants to use brokerage windows whcih is a tool used by savers to self-select their retirement investments Tuberville said:

“The agency’s new guidance ends this tradition of economic empowerment in favor of big-brother government control.”

The Senator believes that the people in the US should be able to invest their retirement savings as they choose and the Financial Freedom Act will enable them to do this if it passes Congress where there’s a lot of resistance to the crypto industry. The bill will prohibit the Labor Department from limiting the type of investments US citizens can have in their accounts:

“Whether or not you believe in the long-term economic prospects of cryptocurrency, the choice of what you invest your retirement savings in should be yours — not that of the government.”

Senators like Cynthia Lummis and Tuberville are battling to make crypto assets more accessible to the people in America and stem the tide of the regulation which the incumbent political stalwarts seem quite intent to impose. In the related developments, the crypto critic Senator Elizabeth Warren was attacking the industry once again and took aim at the investment giant Fidelity over the plans to include crypto as a part of the retirement packages. The country’s biggest 401K pension provider announced it will include BTC on its Platform and Warren took a hit at this claiming that the BTC volatility is compounded by the susceptibility to the whim of influencers.

She even sent a letter to Fidelity’s CEO this week asking what measures the company is taking to battle volatility and it is not the first time that Warren tried to quash the sector with the legislation. As Tuberville pointed out, it has to be the choice of the individual and not one of the senior politicians that are hell-bent on crushing the industry in its entirety.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post