The Aave token surges by 30% as the whales and the sharks started accumulating following its V3 update as we can see in today’s latest altcoin news.

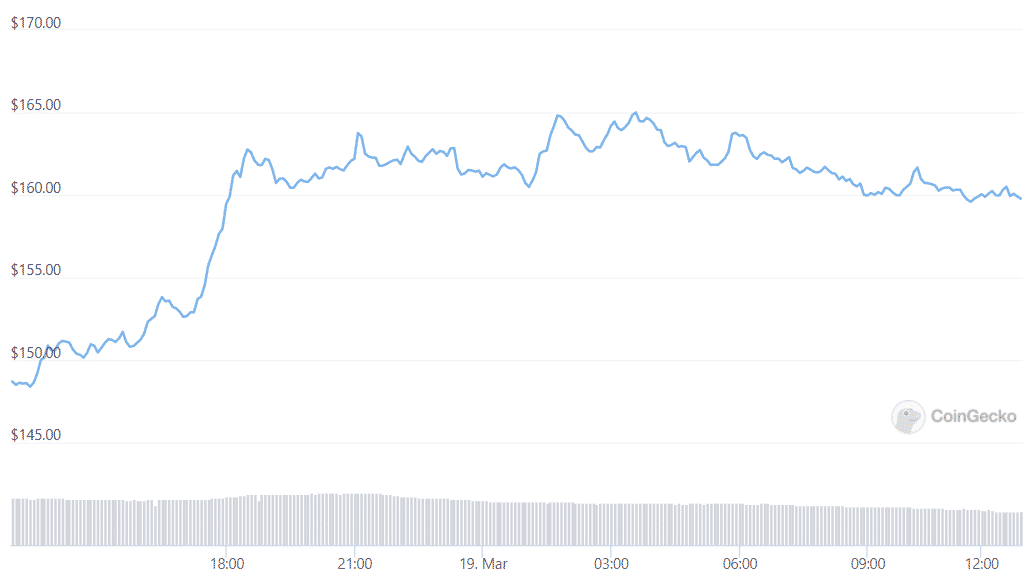

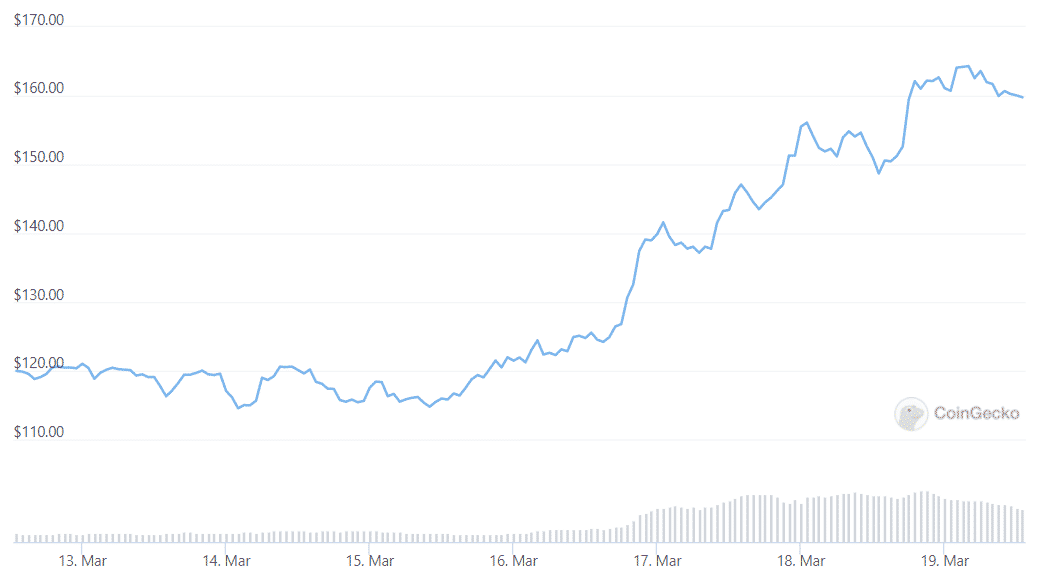

The lending protocol’s token is up by 30% in one week after the V3 update and the Aave token surges are still due to the whales and sharks accumulating over 70,000 coins in the past two months. The upgrade introduced cross-chain portals and allows users to take their assets to other versions of the protocol on other networks. It also reduced gas cots for all Aave functions by 20-20%. Aave’s price increased sharply since and started at $124 and has increased now to $158 at the time of writing.

This marks a 32.9% gain in the past week since AAve was set at $116. Similar to BNB, AAve offers its holders a discounted trading fee when using the Aave protocol and operates as a governance token which gives holders a say in its future development. The all-time high was achieved back in May when the coin hit $661 however it is still down by 76% from that time. The trading volume is now at $475 million with highs not seen since early this year. Whale accumulation has been on the rise at the same time and according to the on-chain metrics, the users holding $152,000 and $1.52 million in Aave accumulated over $10.5 million in the token since January.

As recently reported, The latest upgrade to lending and borrowing protocol Aave was greeted with a surge in buying activity. The project’s native ERC-20 token AAVe which is used for staking and governance and the blue chip token Aave surged by 17% over the past day according to the data from CoinMarketCap.

Aave’s latest price action has been driven by the launch of the V3 upgrade. The updates often include integrations with Layer-2 scaling solutions and optimizations for gas costs with tons of wallet integrations and more. The ETHLand in 2017, Aave is the DeFi sector’s largest protocol by total value. According to DeFi Llama, Aave has a whopping $19.37 billion and the entire sector holding about $250 million gives Aave about a 7% slice of the market.

The central bank of Brazil revealed that it picked a total of nine projects to go forward in its challenge to develop a central bank digital currency and one of the projects is Aave. The central bank of Brazil revealed the LIFT challenge where the current theme is “Real Digital.” the main goal of the challenge is to evaluate all use cases of CBDCs issued by a central bank and how technologically feasible they are.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post