Aave Rises 20% with all DeFi coins starting a new resurgence wave that came after the Ethereum rally so let’s read more in today’s altcoin news.

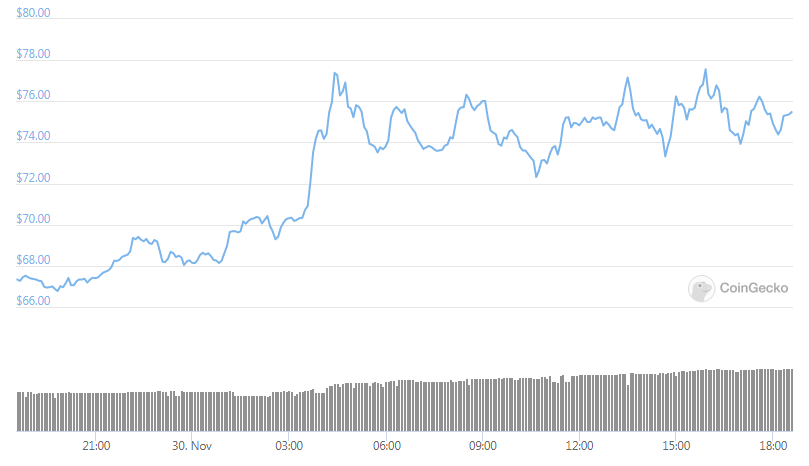

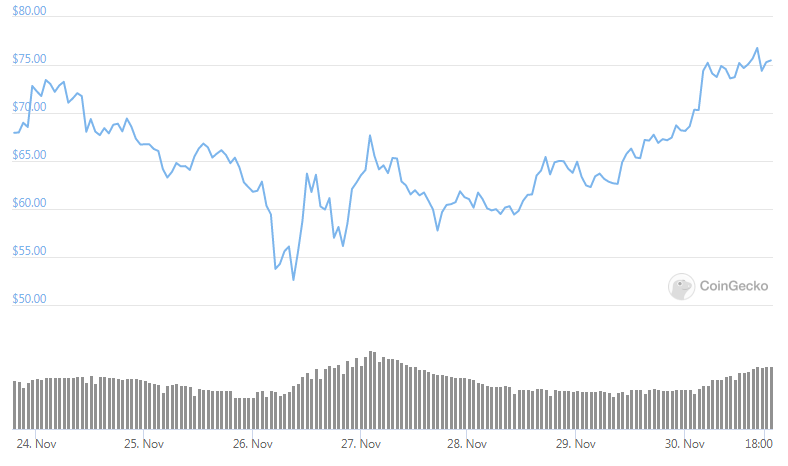

The top decentralized finance coins like Aave, outperformed during the past day. While both Bitcoin and Ethereum increased massively over the day, AAVE increased by 18.5% in the past 24hours alone. The performance made it the best digital asset in the top 100 by market cap so AAVE is now up by 10% on a weekly basis according to the data on CoinGecko.

The rally only outlined the growing interest in DeFi which continued to gain fundamental strength despite the slow price action. The number of DeFi users will likely hit one million soon and will make it among the first crypto technologies that is accepted by so many people. Aave will likely benefit from this trend since it is sitting on top of the core of the ecosystem as a money market for lending and borrowing. AAVE rises by 20% over the past 24hours thanks to the strength in Ethereum’s price. ETH gained about 5% in the past 24hours and hit the 0 level after consolidating under 0 for a few days.

buy antabuse generic buy antabuse online no prescription

The gains eventually led other coins in the DeFi space to rise as well, just like Aave did.

Aave is one of the biggest ETH-based defi coins with a value of $890 million. The governance token allows users to govern the protocol and it also has a coin that is used as a backstop for the protocol if there’s a glitch. The latest price boost came when Aave set a milestone, according to Marc Zeller who is a part of the new Aave core team:

“The 3 comas club has a brand new member with the @AaveAave Flash loans. 1 Billion thanks to all the devs being pioneers of innovation, @DeFiSaver @fifikobayashi, and all the others. Can’t wait to see y’all all experiment with Seamless Loans made possible with @AaveAave v2.”

The rally happened thanks to the fundamentals of the DeFi space improved at a fast rate. According to the DefiPulse site, the total locked value of the coin in decentralized finance contracts surpassed $14 billion which means it is up by $500 million from the start of 2020.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post