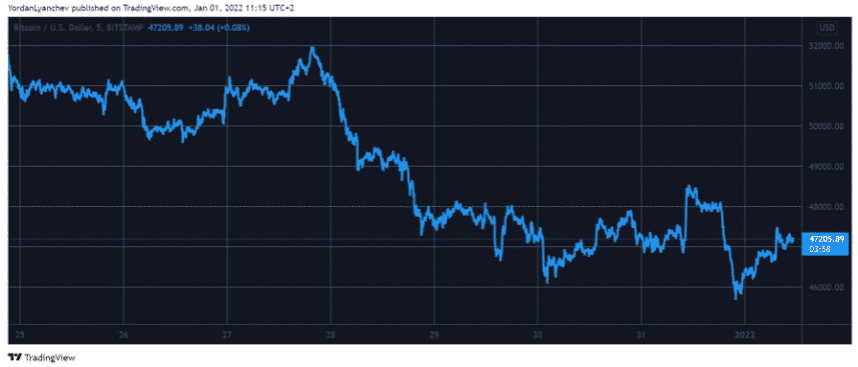

2022 started in red as Bitcoin slid below $47,000 but AVAX, however, is the only larger-cap coin that was in the green so let’s read more in today’s latest altcoin news on the first day of the year.

Following yesterday’s sudden price pump to $48,000, BTC headed right sought and dipped below $46,000 hours later with the other altcoins also being in the red with over $60 billion gone from the crypto market cap. After failing to overcome $52,000 earlier this week, BTC dumped by $5000 in a few days and the asset struggled below $47,000 for a few consecutive days. The situation changed rapidly yesterday when the crypto initiated a price pump which drove it north by more than $1500 and then managed to surge to $48,500.

However, it failed to continue holding on to its upward trajectory and 2022 started in red. The bears came into play and pushed the asset south by $2500. BTC dropped below $46,000 which became the lowest point in a week. Despite recovering over $1000 since then, BTC’s market cap dropped to below $900 billion. The alternative coins charted some strong gains yesterday. Ethereum bounced off from its price drops and surpassed $3800 but a 2.3% decline on the daily scale drove the second-biggest asset to around $100 lower than that. More losses were evident from Binance Coin that dropped by 2%, Solana by 2.5%, Cardano by 3.5%, Terra by 1.5%, ripple by 1.5%, and Dogecoin by 2% as well. Avalanche’s AVAX is the only exception as It increased by more than 3% in one day and traded to $110 making great way for AVAX in the new year.

Further declines were evident from sushiSwap that dropped by 9%, Algorand by 6%, IOTA by 7%, Gnosis by 6%, and NEAR protocol by 6%. The cumulative market cap of all crypto assets dropped by over $60 billion a day ago to just over $2.2 trillion.

As recently reported, There have been liquidations along with the longs and shorts that came out of the billions of dollars and the investors oftentimes got greedy and had to deal with the consequences of their actions because of the larger number of liquidations in a short period of time. For 2021, there have been a number of memorable liquidations that took place, and once was during the September crash that saw liquidations go into the hundreds of millions. However, the reports show that 2021 culminated with more than $100 billion in liquidations.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post