The 1inch DeFi Platform released its new governance and utility token and will now govern both the automated market maker and its DEX aggregator so let’s learn some more about it in the latest crypto news.

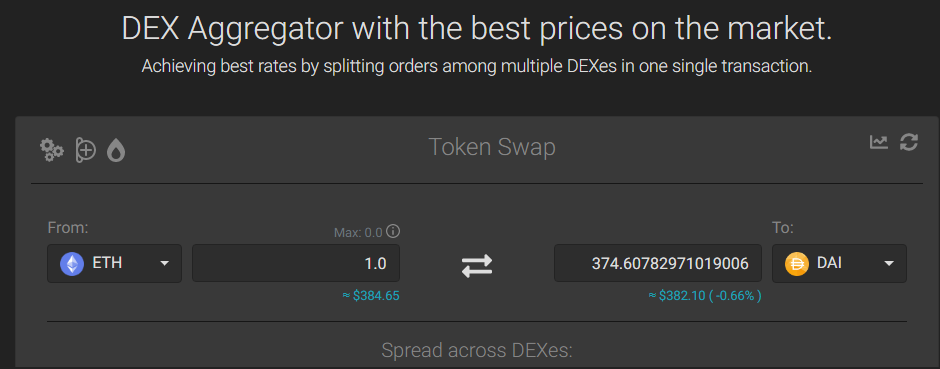

The team behind the 1Inch Defi platform released a new utility token according to the latest announcement. The token will be used for both the automated market maker protocol and the decentralized exchange aggregator service. the new Aggregation Protocol governance module will allow the stakers to vote on the distribution of the Spread Surplus coins. These come out when the final rate for a transaction undertaken through the aggregator service is much bigger than the one confirmed by the user.

1/ Delighted to announce that 1INCH Token is LIVE! 🌟

Learn more about the governance/utility token and the token architecture: https://t.co/6POyBLHmKO

⬇️

— 1inch.exchange (@1inchExchange) December 25, 2020

The proceeds are split between the referrer and the governance reward with the proportion that goes to each one is decided by the DAO. The governance reward will be set to zero. Spread surplus coins will be converted into 1INCH tokens via the liquidity protocol that was known as Mooniswap. The Liquidity Protocol governance module will allow the stakers and liquidity providers to vote on the protocol parameters which include price impact fee, swap fee, and referral rewards.

Some of these parameters will be governed on an individual liquidity pool basis while others will apply to all pools. There will also be a liquidity mining program introduced for 6 pools pairing the 1INCH tokens with the DAI, ETH, USDC, USDT, YFI, and WBTC. 30% of the token supply of 1.5 billion tokens were allocated to the community incentives over the next few years. Another 14.5% is reserved for the protocol growth and the development fund which will be unlocked over the next four years.

The initial circulation supply on release day will be set for 6% with another 0.5% being issued during the first two weeks of the mining program. This will begin on December 28, at midnight. Earlier this month, 1Inch closed its $12 million funding round that was led by Pantera Capital.

As recently reported, 1inch DEX aggregator has successfully raised $2.8 million in a financing round by Binance Labs as a venture arm of the leading crypto exchange. The 1inch DEX aggregator that sources liquidity from multiple platforms raised about $3 million in a funding round led by Binance Labs. There were other prominent participants such as Libertus Capital, Galaxy Digital, Greenfield One, FTX, Divergence Ventures, and more.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post