$180 million SUSHI tokens from Uniswap were migrated to SushiSwap and the migration was approved by the community as we are reading today in our altcoin news.

About 87% of the votes were in favor of the migration and there is a close to $180 million SUSHI tokens worth of liquidity in the ETH/SUSHI pair on Uniswap. The total value of the SUSHI token grew from zero to $1.4 billion in a few days and this will place the recently launched Defi project right behind Uniswap, shoulder to shoulder with Aave and Maker. Like other projects, it was launched with limited audits and according to a review by Quantstamp, there are a few security vulnerabilities but none of them are critical. Quantstamp communications manager Jaye Harrill said:

“On the surface Sushiswap looks like another nightly-built vegetable farm with endless APY launched by the anonymously named NomiChef. But looking deeper we find a highly engaged community on discord genuinely discussing the growth of the very project they are invested in.”

PeckShield also performed a formal security audit of the code and didn’t find a lot of vulnerabilities either. The idea behind the fork is to achieve bigger decentralization of the project as the anonymous founders will keep 10% of the token supply.

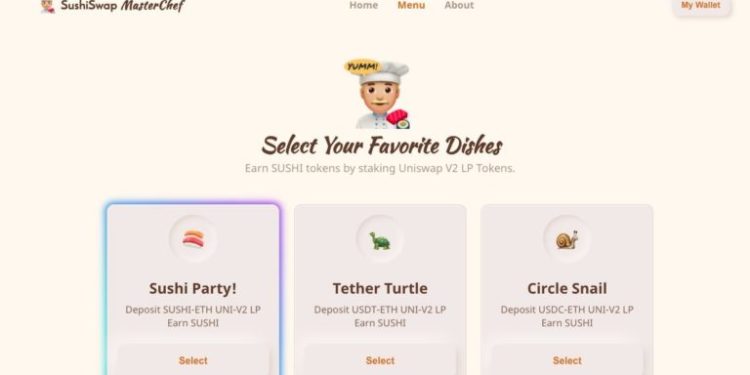

The Sushiswap newbie in the Defi space has locked up a nine-figure number in a few days after the launch. According to the data from the on-chain analysis company DeBank, Sushiswap liquidity miners have locked up altogether, about a billion dollars in the project. The goal is to create a liquidity pool on Uniswap with the tokens listed and come back to deposit these LP tokens for farming SUSHI.

The Uniswap opponent Sushisawp has to be audited still which means it could be a risky investment if things don’t turn out fine. It was a record-breaking weekend for Uniswap as it hit the highest daily trading volume ever and behind its success over the weekend was the crazy price increase of the DeFi governance token which was launched a couple of days ago. Sushiswap is quite similar to Uniswap as it is a liquidity provider that rewards everyone who puts liquidity into its smart contracts with a portion of the trading fees. But in addition to that, Sushiswap offers SUSHI tokens that work as an incentive for contributing to its liquidity pool.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post