The Cryptopia exchange gets hacked again despite being in liquidation while the hacked wallets belonged to a creditor, Stakenet which hadn’t lost the funds in 2019 as per the reports that we are reading more in our latest crypto news.

The Cryptopia exchange gets hacked again despite being liquidated following the last breach that ended up draining $15.5 million from the platform. According to the Stuff report, the creditor, US company Stakenet was told that about $45,000 in XSN crypto were transferred out of the cold wallets since the month started.

Unused since the last hack that destroyed the platform, the wallet is reported to contain crypto assets worth $1.97 million in total. Liquidator Grant Thornton from New Zealand said that it hadn’t authorized the movements of the funds and that they are investigating the incident. Stakenet didn’t lose the funds in the hack back in 2019 and was hoping to receive all the assets back, as the company said:

“If this unauthorized transaction has happened under Grant Thornton’s watch then they need to explain to the users why they failed to secure … [the] assets like they were supposed to do and how someone was able to access them.”

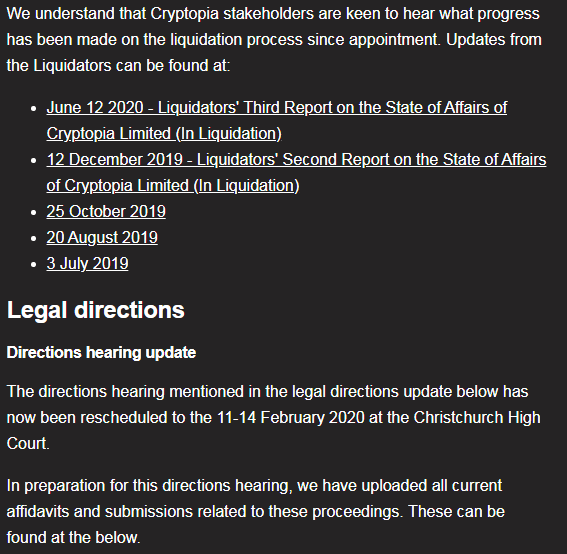

The news came after Grant Thornton finally started allowing the former users of the platform to enter their claims to retrieve their assets.

As reported previously Legal representation for GNY, the company that is focused on artificial intelligence and the issuer of LML, filed a notice to the liquidators’ failure to comply with the duties. Grant Thornton was accused of botching their handling of hacked and defunct cryptocurrency exchange Cryptopia. This notice is the final step before a lawsuit which will only add more to the entangled case for trying to return the funds from a compromised crypto platform.

The hackers accessed the Cryptopia crypto exchange back in 2019 and made off with an estimated $16 million. GNY claimed about $18 million in their claim with the creditors in 2019 and according to the analysts, the company lost about $2.5 million worth of Bitcoin at the time of the claim. Grant Thornton protested previously that the deadlines it faced were unreasonable. A GNY representative explained that the ethic failures on the part of Grant Thornton are worrying that the former was ignoring the creditors in order to fill his own pockets. GNY’s founder described the pursuit as getting a seat at the table saying that Thornton ignored the claims through the liquidation process.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post