Crypto DEXs grew bigger than the centralized exchanges in the third quarter of this year although they still attract most of the trading volume market share. The decentralized exchanges are on the rise with triple-digit growth in the third quarter as we are reading more in our latest crypto news.

In the latest reports summarizing the third quarter developments in the crypto space, CoinGecko classified the outcome as the “summer of decentralized finance.” The data aggregator noted that the Crypto DEXs got massive growth in terms of trading volume resulting in reduced market share of centralized exchanges. The reports noted the developments within the decentralized finance industry and mainly the performance of DEXs. According to the data in the document “Q3 2020 had been vibrant quarter where the DeFy hype and yield farming frenzy took over the crypto sphere which resulted in the $155 billion increase in total trading volume.”

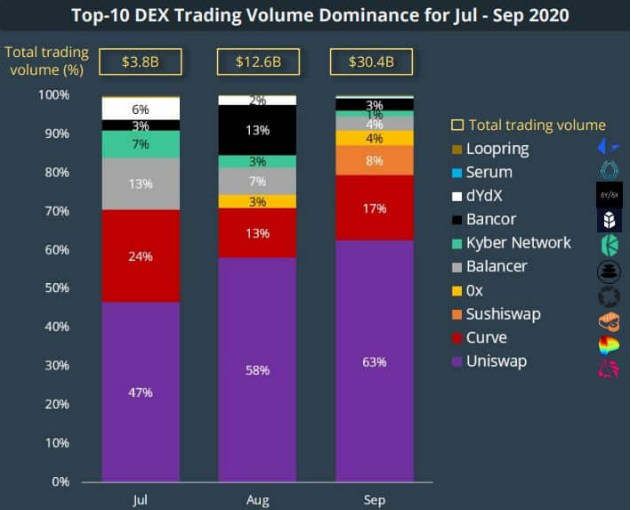

As the charts show, August and September saw a huge increase in trading volume as the DEXs enjoyed massive surges in the market share from $3.8 billion in volume to over $30 billion in September. The growth outpaced the centralized exchanges which decreased in September:

“Centralized exchanges still have the bulk of the trading volume, but obvious erosion of market share by DEXes have been observed. Currently, DEX volume stands at 6% of CEX.”

The report went into more detail in examining the top 10 DEXs and their market share. It concluded that Uniswap continued to be the most widely utilized decentralized exchange. Uniswap was responsible for 47% of the $3.8 billion trading volume and the volume expanded to $30.4 billion in September while Uniswap’s share increased to 63%. Curve is the other exchange that is consistent with a double-digit trading volume percentage but it dropped from 24% to about 17% in September. CoinGecko outlined Sushiswap’s role as the dark horse in the race as the platform started as a fork of Uniswap.

Sushiswap attracted a substantial amount of Uniswap’s liquidity during the explosive start by offering more incentives in what was known as a “vampire attack.” Despite controversies about the project, SushiSwap was responsible for 8% of the total decentralized trading volume in September:

“Uniswap and Curve further cemented their positions as leading DEXes, but it remains to be seen if SushiSwap can continue to grow its market share.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post