Voyager to return $270 million to its customers, meaning that a portion of the client cash frozen at the Metropolitan Commercial Bank up until now will be released to the cryptocurrency lender.

Contrary to the investment firm’s ongoing public remarks, troubled crypto lender Voyager Digital Holdings claims it has received a number of “higher and better” buyout proposals than the one made by AlamedaFTX back in July.

The court overseeing the business’s bankruptcy proceedings in New York has now given the corporation permission to restore $270 million in client funds stored at the Metropolitan Commercial Bank (MCB).

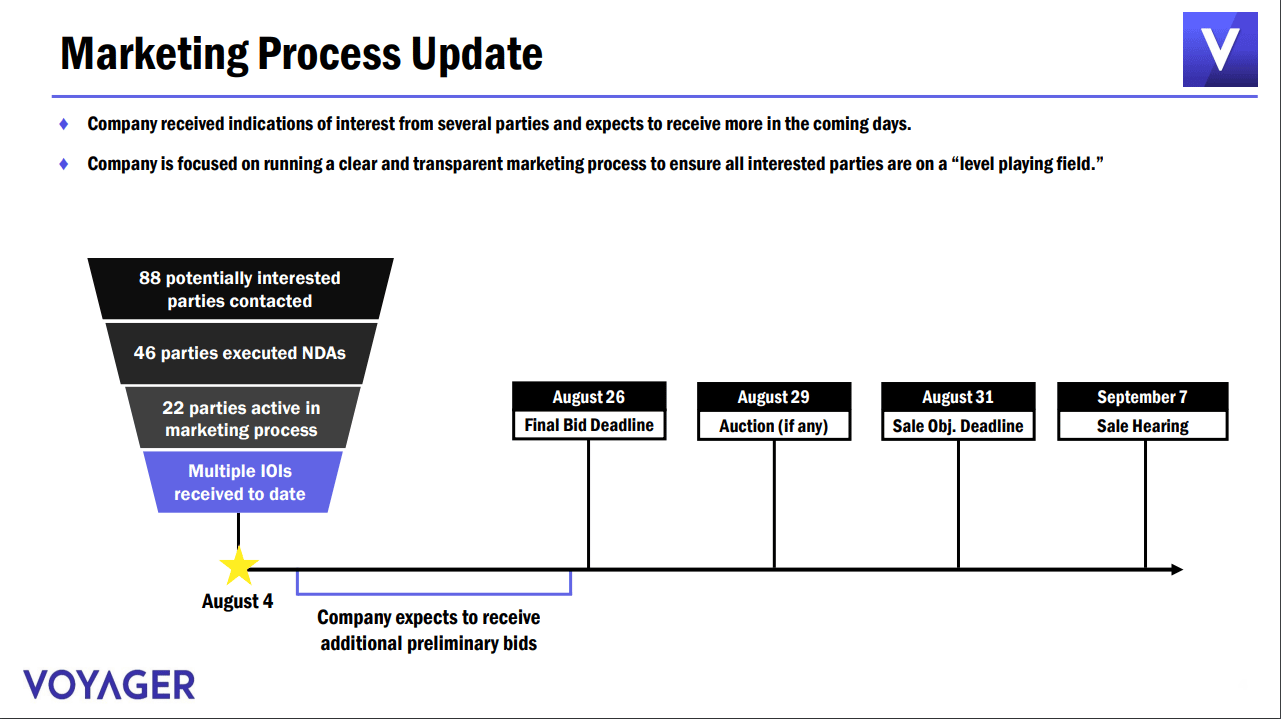

Voyager said it has heard from up to 88 interested parties who want to help the firm out of its financial troubles in a presentation for the Second Day Hearing on Thursday. It also said it is in “active negotiations” with more than 20 possible interested parties.

Alameda and FTX made one of the most well-known bids in July.

With the exception of the Three Arrows Capital loan that had defaulted, Alameda had proposed to purchase all of Voyager’s assets and outstanding loans. After the assets were liquidated, the proceeds would be distributed in USD via the FTX US exchange.

Voyager rejected this on July 25 because it was not “value-maximizing” for its clients.

Contrary to alleged “inaccurate” public comments from AlamedaFTX, the company also stated that it has already received bids through the marketing process that are “higher and better than AlamedaFTX’s proposal.”

In order to prove that AlamedaFTX does not have a “leg up” over other bidders, Voyager said that it has also separately sent AlamedaFTX a stop and desist letter regarding its “inaccurate” public remarks.

Return of $270M in customer funds

The disclosure of more interested parties coincides with U.S. Bankruptcy Court Judge Michael Wiles’ approval for Voyager to return $270 million to customers.

The custodial account at the Metropolitan Commercial Bank, which is believed to contain $270 million in cash, is held in custody, according to a Thursday report from the Wall Street Journal. Wiles claimed that Voyager had provided a “sufficient basis” for its claim that customers should be allowed access to this account.

When Voyager filed for bankruptcy on July 5, there were funds hidden in the bank account. When bankruptcy proceedings were underway, those funds were blocked.

buy synthroid online https://rxbuyonlinewithoutprescriptionrx.net/synthroid.html no prescription

The firm apparently requested that the money in the MCB be released on July 15 after Voyager Digital CEO Stephen Ehrlich stated in July that he intended to refund customer payments from MCB once a “reconciliation and fraud prevention process” was finished.

Voyager is not the only cryptocurrency brokerage, lender, or investment organization that has struggled for both itself and its users, owing a total of no more than $10 billion to about 100,000 creditors. In the ongoing drama, other parties like Celsius, Three Arrows Capital, BlockFi, and others have also been involved.

Check out the latest cryptocurrency news.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post