BTC crashed to 7-day low as UNI Slumps by 8% on the news of the phishing attack on the platform so let’s read more today in our latest altcoin news.

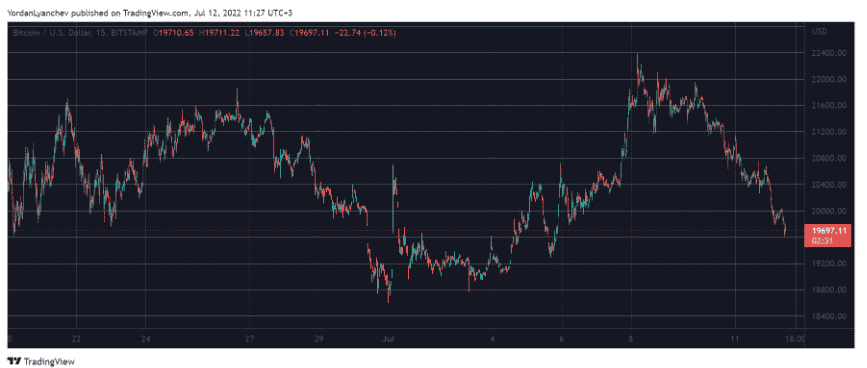

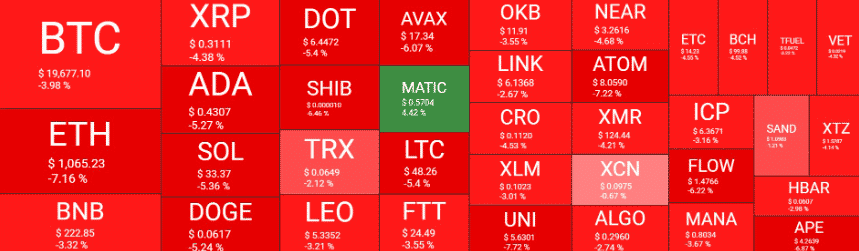

The adverse price developments continued in the past 24 hours and BTC slipped to the lowest position in one week below $20,000. The altcoins are not doing much better either with ETH dumping by 7% and UNI by 8% after a recent phishing attack. It was only a few days ago when the main cryptocurrency was shooting higher and painted a peak of $22,400 and the entire community was preparing for another increase but the situation changed and BTC crashed to 7-day low.

It all calmed down over the weekend and the market spend the trading sideways around $21,500 but the Sunday was already looking quite gloomy as it started dumping again and BTC hit $20,000. the bulls defended that coveted level but gave in hours ago. BTC slumped below it and then dropped to $19,500 which became the lowest price point since July 5. As of now, the asset stands a few hundred dollars above the level but the market cap is down to $375 billion. The price crashes came as the majority of the Wall Street investors predicted a further drop to $10,000 before the surge to $30,000.

The CoinShares CSO said the crypto winter is not even close to the end as there are no signs of a trend reversal. The altcoins followed BTC on its way south, and ETH leads this trend as well. The second biggest crypto is down by 7% in the past day and it is getting closer to $1050 so similar to BTC, ETH was at a weekly high of $1250 days ago. Most notable prices were evident from Solana, DOGE, Cardano, DOT, and SHIB from the larger cap altcoins and some modest gains were evident from Tron, LEO, BNB, and Ripple on a daily scale.

Uniswap is among the worst performers after a recent phishing attack against the protocol and UNI is down 8% and trades at over $5.5. The crypto market cap declined by another $40billion in one day and below $900 billion. The CEO of Kucoind denied the rumors that his company had to lay off staff members like Coinbase, ByBit, and other exchanges did. Voyager Digital warned the clients that not all of them are able to receive the crypto their put on their platform and a recent court filing asserted that Kyle Davies and Su Zhu are missing from their offices in Singapore. The market crash prompted the Financial Stability Board to also propose a global regulatory framework.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post