The US leads in crypto ATM installations and the BTC hash rate across the world so without China in the picture, the US is picking up the slack so let’s read more today in our bitcoin news.

The US leads in crypto ATM installations and its BTC hash rate contribution represents 37.84% of the total mining power by the start of the year. Despite the difficulties and federal regulatory hurdles that crypto businesses faced in the region, the US plays a huge role in preserving BTC. With China moving out of the picture, the US is at the top position in terms of hash rate contribution and ATM installations.

Before cracking down on BTC mining, China represented over 50% of the hash rate by 2021 and now that China is out of the picture, the US picked up the slack to become the highest hash rate contributor representing 37.84% by January 2022. As the data shows, Chinese miners resumed operations in 2021 but the miners in the US continued to dominate the space and increased the hash rate contribution every month.

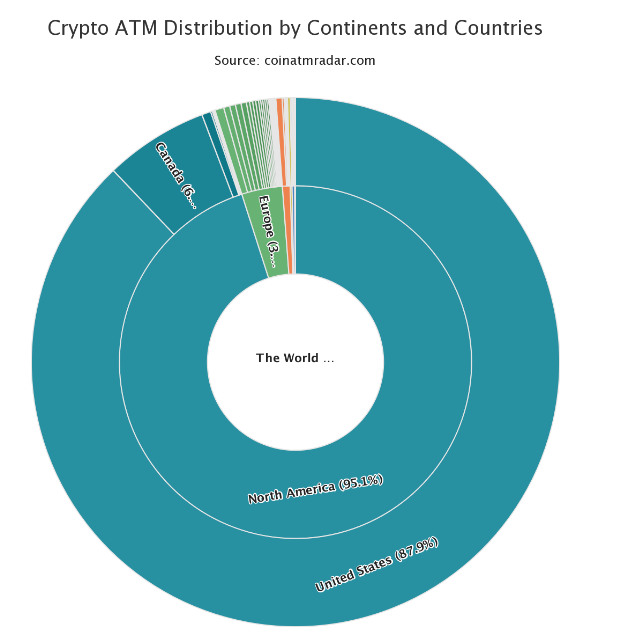

In addition, the US is home to the highest number of ATM installations and represents 88% of the total crypto aTM installations with over 90% of the crypto ATMS installed in the past few months in the US. The data from Coin ATM radar confirms that the trend continues this month as well with the US seeing installations of 641 out of 710 BTC ATMs during the first 10 days of the month. The further enhancement was with North America’s position in the crypto ecosystem. Canada represents the second biggest network of ATMs in the US and outside of the US, Spain houses the highest number of ATMs.

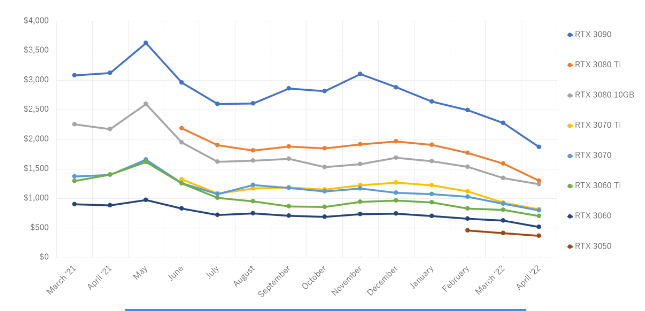

The confluence of the global chip shortage and the cOVID pandemic increased the prices of the mining rigs and the GPUs but the prices are now falling down below MSRP and with the hash rate that compliments the fall, miners are founding themselves at an opportunity to procure their mining equipment dream. In May alone, GPU prices dropped by 15%.

As recently reported, As a result of the falling BTC prices, the total revenue earned by the miners in transaction fees and the mining rewards dropped to a one-year low of $15 million but the global GPU prices drop and they can help miners offset their operational costs amid the bear market. BTC mining revenue dropped 79.6% over a period of 9 months since reaching an all-time high of $74.4 million in addition, the global chip shortage and the COVID pandemic shot up the prices of the graphics processing unit impacted the miners’ bottom line.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post