The global GPU prices drop to compensate for the falling Bitcoin mining revenue and this also opened up a smaller window for small-time miners to procure a piece of powerful equipment so let’s read more today in our latest Bitcoin news.

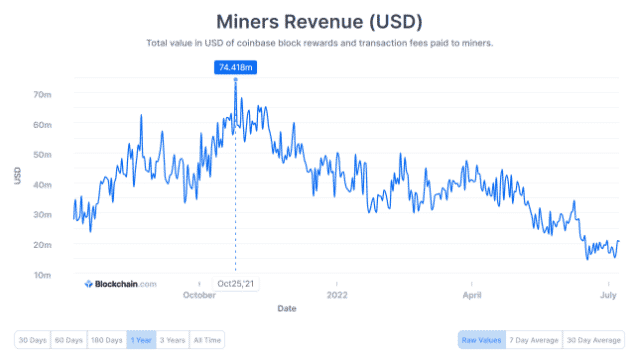

As a result of the falling BTC prices, the total revenue earned by the miners in transaction fees and the mining rewards dropped to a one-year low of $15 million but the global GPU prices drop and they can help miners offset their operational costs amid the bear market. BTC mining revenue dropped 79.6% over a period of 9 months since reaching an all-time high of $74.4 million in addition, the global chip shortage and the COVID pandemic shot up the prices of the graphics processing unit impacted the miners’ bottom line.

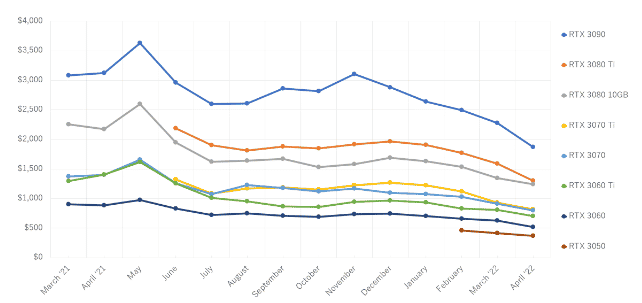

With the card manufacturers resuming operations worldwide, GPU prices saw a massive decline with cards selling below MSRPS and in May alone, the GPU prices dropped by 15% on average as the supply surpassed the market demand. The recent influx of the GPUs also forced the sellers on the secondary markets to bring the prices down on the used mining rigs. The reports shwoed that the BTC miners are in a good position to survive the bear market as the low revenue continued to sustain the operational costs of the mining facilities and as shown in the charts, Argo, MArahton, Riot, and CleanSpark are some of the miners that have a stable mining revenue which is a fair indication of good health.

The meteoric drop in GPU prices opened up a smaller window of opportunity for small-time miners to get a piece of powerful mining equipment and coupled with the lower hash rate requirements, the miners require low computing power to mine the block on the BTC blockchain. Despite the drop in mining revenue, Marathon Digital Holdings revealed that they are continuing the stacking BTC via mining while being well insulated and in a good position. The VP of Corporate communications at Marathon Digital, Charlie Schumacher noted:

“For reference, in Q1 2022, our cost to produce a Bitcoin was approximately $6,200. We also have fixed pricing for power, so we are not subject to changes in the energy markets.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post