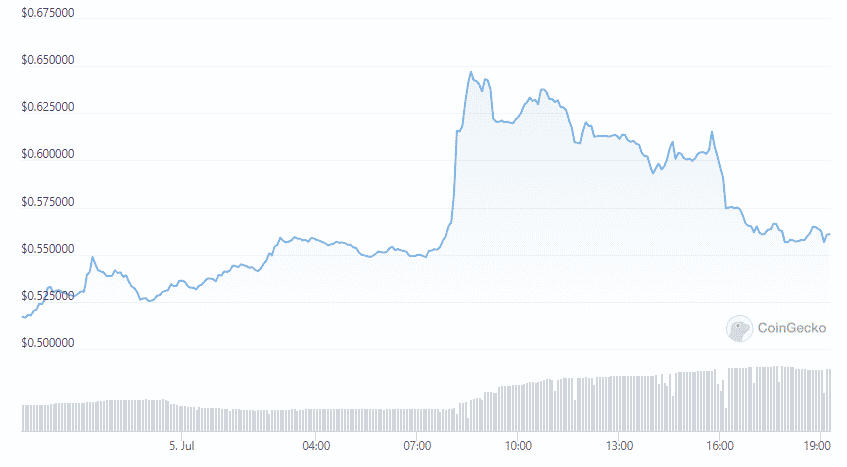

Lido token surges 24% with the staked ETH slowly re-pegging and now it is stabilizing which prompted a rise in the native token so let’s have a closer look at our latest altcoin news.

Lido’s token surges 24% in the past 24 hours, hitting a new high of $0.66 cents. In the meantime, the staked Ethereum token called stETH seems to have grown in value and increased by 5% overnight with the staked version trading at 91 and ETH trading at 27.

buy cipro online https://noprescriptionbuyonlinerxx.com/dir/cipro.html no prescription

the gap between ETH and stETH does represent a discrepancy of 3% for the staked token of Lido.

While this is quite significant, stETH fell 6% short of the market as per the reports by Nansen. Lido’s surging LDO token for the protocol governance enables holders to help manage fees and the token distribution, approve and remove the Lido node operators and vote on the proposals in the Lido DAO so now anyone can become a validator provided they have 32 ETH to lock up to activate the software and to earn rewards for data storage and adding blocks to eTH.

Lido is a staking pool that allows staking any amount of ETH via smart contracts and self-executing financial contracts and the users can earn yields in stETH which cant be redeemed 1:1 for ETH but after the merge, it will be and can also be lent, traded, or staked. Staked Ethereum is issued by Lido to represent eTH that was locked in the ETH Beacon Chain which is a network about to be merged with the Ethereum mainnet in the upgrade that will transition in the entire network to become PoS consensus and render 99.95% more energy.

Lido was at the center of controversy a month ago after Celsius froze withdrawals and stopped a bank run which could have depleted the stETH price and came to light that Celsius staked customer funds and now holds $449 million worth of the coin in a public wallet. Lido ranks as Ethereum’s fourth-biggest DEFI protocol with a TVL of $4.79 billion but the platform accounts for the bigger share of the depositors on the Beacon Chain.

buy symbicort online https://buynoprescriptiononlinerxx.net/dir/symbicort.html no prescription

Despite the centralization concerns, about 99% of the LIDO DAO voted to keep the Ethereum staking capacity uncapped.

The view is not a popular one with many tweeting that the staking domiannce will lead to centralization. In response, Lido insisted the staking is not contrary to the ethos of Ethereum and stated that it was formed to prevent centralized exchanges from getting the bigger share of staked Ethereum and keep it decentralized.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post