Three Arrows paper trails show that its trading desk TPS remains active and its ownership structure could frustrate the creditors’ efforts to collect so let’s read more today in our latest cryptocurrency news.

The epic collapse of the crypto hedge fund Three Arrows Capital unrailed the digital asset industry and contributed to the first crash in Bitcoin’s price. Yet some investors and enforces are following the moeny trail and they point to an obscure legal entity that remains out of the headlines so far but the aggressively trading and possibly shielding some of the assets from recovery.

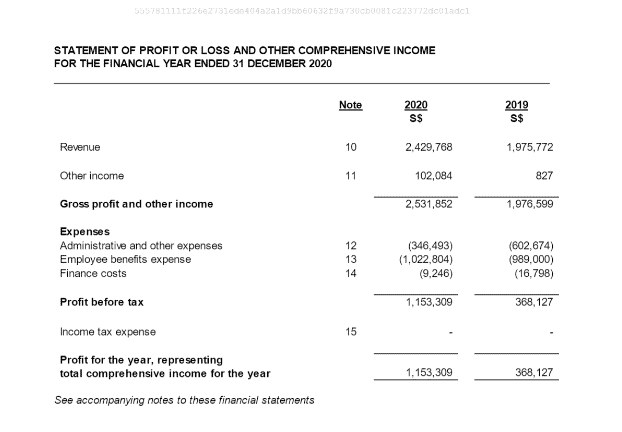

While Three Arrows Capital used its billions of dollars of assets under management to invest in new projects and create larger market positions, also ran an over-the-counter trading desk dubbed Tai Ping Shan Capital with the entity once being described as the official OTC desk for Three Arrows Capital as per the scrapped version fo the site by google however its language has been changed which discounted the two companies.

The three arrows paper trail shows that TPS Capital continues to make trades even as its parent company faces liquidation in the British Virgin Islands and an investigation in Singapore. For those that look for restitution from Three Arrows Capital, the separation could complicate the efforts to obtain a payout named after Tai Ping Shan mountain in Hong Kong, the TPS capital is registered in Singapore but based in the British Virgin Islands.

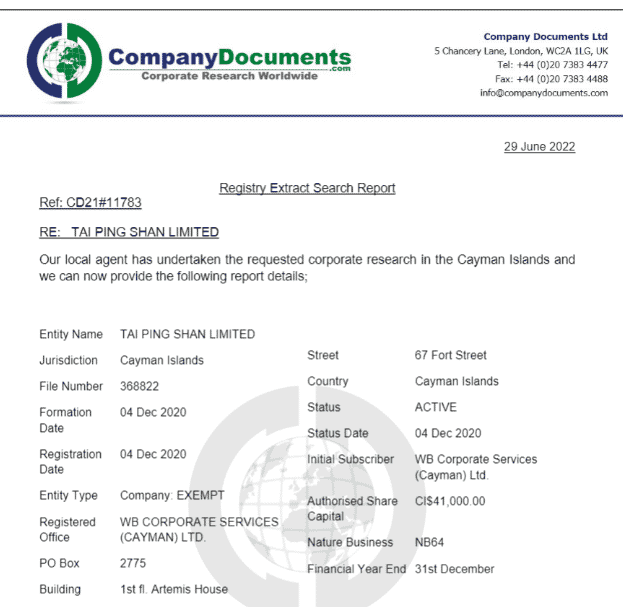

The parent company is facing a lawsuit ut TSP Capital has a different ownership structure as well as some hidden directors. According to the registration documents, the ownership of the paltform is split between a BVI-registered company called Three Lucky Charms LTD, TPS Research, and Cayman Islands-registered Tai Ping Shan. The BI law holds that directors of a company are not public information but the name Three Lucky charms sounds similar to Three Arrows Capital whose founders include Kyle Davies, Su Zhu, and a third individual whose identity remains unclear.

TPS Research owns 47% of the Singaporean entity and keeps the directors hidden. Tai Ping Shan owns 5% of the Singaporean entity tPS Capital and lists Paul Muspratt as the managing director and Steven Sokhol as another West Bay employee. Yi doesn’t have a huge presence online but he is listed as a Director of TPS Capital Canadian entity. Earlier this week, the Singaporean Monetary Authority censured 3AC for misreporting information about its holdings:

“The reprimand relates to contraventions by [Three Arrows Capital] which occurred prior to its notification to MAS in April 2022. MAS has been investigating these contraventions since June 2021.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post