The GBTC discount reaches an all-time low while the SEC BTC ETF decision looms and the decision for the application is getting closer so let’s read more today in our latest Bitcoin news.

The shares of the Grayscale Bitcoin Trust continued to slide and now trade at a discount of 33.75% to the spot price of BTC of a new all-time low since it was launched in 2017. The GBTC discount is reaching new lows but it is a vehicle that enables investors to trade the shares in trusts that hold pools of BTC with each share meant to track the price of Bitcoin. The idea is for the investors to gain more exposure to BTC without having to buy and hold the asset.

We're grateful for your support in our ongoing effort to convert Grayscale Bitcoin Trust into an ETF! $GBTC @Coinbase #Bitcoin https://t.co/kVIa7uSSpC

— Grayscale (@Grayscale) December 16, 2021

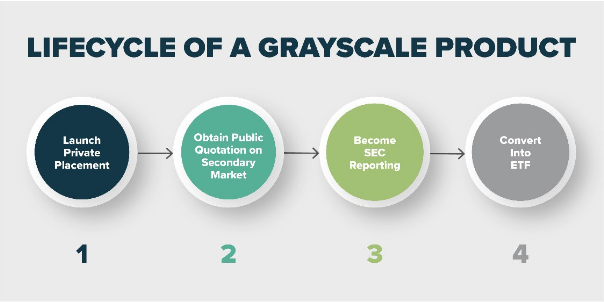

Since February 2021, the shares in GBTC traded at a discount which means that the GBTC trades for less than the net value of BTC needed to back the trust. According to the Grayscale website, the value of the BTC held by the Trust is $13.3 billion. Grayscale believes that the only way to correct the growing discount is to convert the trust into a spot ETF and argued that it is in the best interest of the investors. Converting the trust into the ETF will enable it to charge lower fees and make it easier to move money in and out of the fund.

Although it approved a few BTC futures ETFs, the US SEC rejected every spot BTC ETF application and the regulator cited the potential for market manipulation among traders as a key concern. Grayscale applied to launch the spot BTC ETF in 2016 but then withdraw it after a year and it then formally applied to convert GBTC into a spot BTC ETF and tried to force the SEC’s hand according to sources familiar with the matter.

The SEC repeatedly delayed the decision on a grayscale ETF proposal with the deadline in July for approval or rejection looming. The company responded by having its attorneys write to the SEC and threaten to take them to court, arguing that a spot BTC ETF will unlock $8 billion for investors and will launch a campaign that will encourage people to write to the regulator. Grayscale has a voice of support in the SEC and that is commissioner Hester Peirce who is a long-standing crypto supporter. She wrote:

“It is time for the Commission to stop categorically denying spot crypto exchange-traded products.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post