The macro pressure in the US is responsible for the BTC downturn as there were multiple sell-off trends responsible for the drop in prices that were recorded in the past few months so let’s read more today in our latest Bitcoin news.

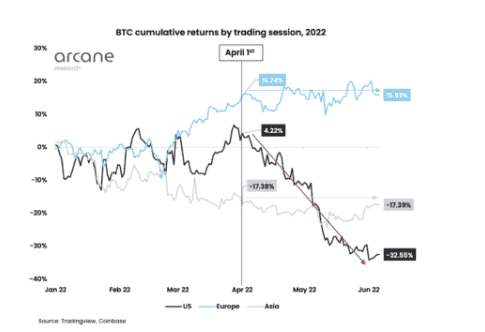

The sell-off trends can be recorded on their magnitude depending on when the trading hours of the reigon are open but this time around, it seems that the macro pressure on the market was the culprit. The sell-off in the past two months was brutal and dragged down the year-to-date values but it seems that most of them, were taking place in the daytime trading hours in the USA. This can be seen by looking at the year-to-date values in the US trading hours compared to one of the European year-to-date values. The stark contrast unveiled where most of the sell-off happened.

As it now looks, the year to date values in the US trading hours dropped into the negative and it is now sitting at -32% while the EU counterpart is looking at a positive year to date value of +16% whcih shows that the sell-off in the past two months originated from the American markets. This is a comparison to the Asian trading hours which shows a favorable year-to-date value compared to the US. This is quite obvious because of the high correlation between BTC and equities markets for the past two months and it is also good to note that the American traders are not the only ones that used the macro markets to assess risks in BTC. Since the traders in other regions use the equity markets as well, they could be dumping bitcoin during the US trading hours too.

The macro pressure in the US can be responsible for the drop in market prices and it has been obvious that there was a lot of sell-offs happening in the US markets that are open for trading. This can be seen from the fact that the price of digital assets tends to recover in the early hours of the morning while the Asian markets and the EU markets are open. However, once the US markets open for the day, the downtrends are apparent.

This puts Bitcoin’s weak point in the times when the American traders are active and as such, the trading hours can present a buying opportunity for the interested parties and a way to exeucte faster plays for bigger gains. However, it is important to note that the tide can change at any point and the selloffs can halt as fast as they started. A change in trend in the US hours can affect the short-term plays which often cater to the trading hours sell-offs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post