Long-term BTC holders begin distribution preceding price bottoms and the bearish price action keeps the concerns over distribution among the long-term holders so let’s read more today in our latest Bitcoin news.

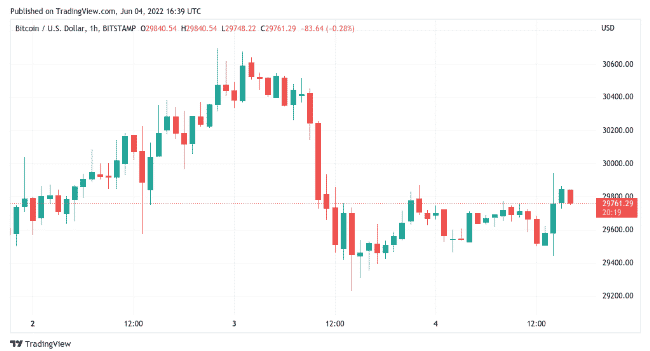

Bitcoin stayed in a tight range as traders’ demands for a new low persisted and the data shwoed that the BTC/USD remained stuck below $29,000 and $30,000 into the weekend. The pair managed a revival to $31,000 but the last Wall Street trading session put pay to the bull’s efforts. The “out-of-hours” markets offered some thin volumes but almost no volatility as the eyes were on the potential direction of what would be an inevitable breakout. Crypto Tony analyst announced:

“The weekly chart on Bitcoin looks nothing short of horrific and so the trend continuation remains. I do think we consolidate a little longer in this range before dropping eventually.”

A further post reiterated a target of $22,000 and $24,000 for BTC after the drop happened. He added:

“I am looking for another drop down to $24000 – $22000, but of course distribution takes time. So we may be hovering around this support zones before any drops just yet.”

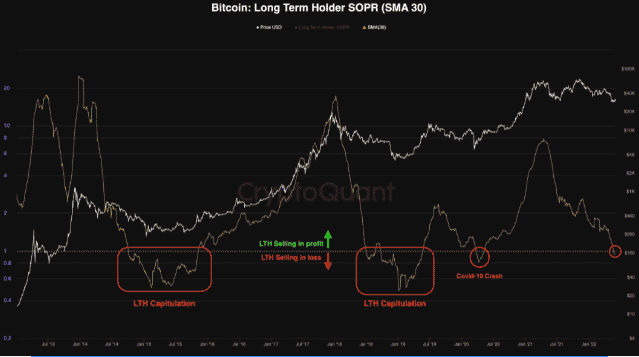

Others planned to make the most of incoming weakness like the popular Twitter account Cryptotoad which annoucned a new strategy of accumulating $27,000 and under in what was a swing low for BTC/USD. Other sources were eyeing lower lows for BTC ranging from the on-chain analysts to the well-known pundits like Arthur Hayes, the former BitMEX CEO. Adding more fuel to the fire was the data from CryptoQuant which signaled that the long-term holders were starting to move their stash in a classic bear market move. Another analyst added that the long-term holders’ capitulation phase started.

Commenting on the charts of the long-term holders, the Spent Output Profit Ration, there were comparisons to conditions that preceded generational bottoms in the BTC history. These included the 2014 and the 2018 bear markets but also the COVID-19 cross-market crash of March 2020:

“Currently, the long-term holders are entering the capitulation phase and are selling at a loss, indicating that the smart money accumulation phase has begun, and the next few months would present a great opportunity for long-term investing in the market.”

In a hint that some were already buying the dip, the exchange data showed that outflows were beating the inflows in the past few days. According to the on-chain analytics firm Glassnode, the net flows from major exchanges totaled 23,286 BTC.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post