Despite 9 red candles, Bitcoin still has strong fundamentals according to the latest reports by Ark Invest that we read more about in today’s latest Bitcoin news.

The report contains a simple compilation of the facts that show a clear picture of the BTC market as it now stands. The blockcahin is an unalterable showcase of evidence and ARK put their bets on analysts to review it and get more insights about the price analysis. ARK Invest Analyst Yassine Elmandjra described “the Bitcoin Monthly” as “Starting this month, ARK Will publish in-depth reports covering Bitcoin’s market action and share what we think the market is headed.”

On the ARK website, they described the venture as:

“Considering the market’s fast pace of change, ARK publishes The Bitcoin Monthly, an “earnings report” that details relevant on-chain activity and showcases the openness, transparency, and accessibility of blockchain data.”Bitcoin closed the month of May down 17.2%, declining from $38,480 to $31,835.”

Excited to introduce the first official issue of “The Bitcoin Monthly”

Starting this month, ARK will be publishing an in-depth report covering Bitcoin’s market action and sharing where we think the market's headed.

Here are the major highlights from this month’s report:

— Yassine Elmandjra (@yassineARK) June 3, 2022

Currently, this looks like the start of a bear market, and with the Terra crash being the catalyst event, but subsequent data shows that we might not be in on after all:

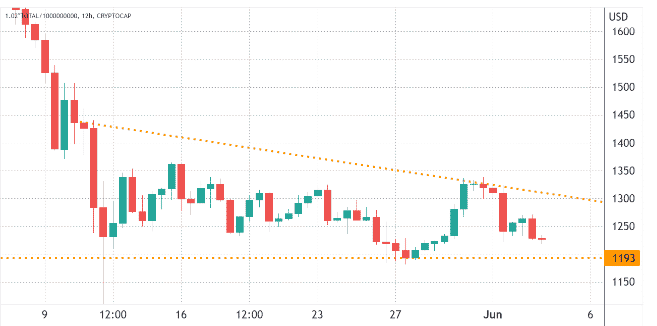

“Bitcoin closed the month down 17.2%, printing its ninth consecutive negative weekly decline for the first time in history, suggesting a possible oversold condition.”

Despite 9 red candles, it seems that bitcoin still has strong fundamentals but also ARK suggests BTC is in a possible oversold condition which is actually promising:

“Bitcoin is down 57% since reaching an all-time high in November 2021. For perspective, the average peak-to-trough drawdown during previous bear markets stands at 76%.”

However, does this mean things will get worse? Or it means that were are not near the bear market at all. Despite the sell-off, BTC hasn’t broken below any major trendline and it is trading above the on-chain cost basis of $24,000 and its 200-week moving average. The BTC network absorbed the Terra selloff and it seems to be behind it now as it hasn’t broken any major trendline levels. About 66% of the BTC supply hasn’t moved in over a year which only confirms the market’s long-term focus and the holder base that has a stronger conviction. Despite the massive market movement, Bitcoin holders are holding on to their coins like it is the only chance at economic freedom which they will see in their lifetime:

“Short-term holder positions fell -35% below their breakeven price, on average.”

If the bitcoins are holding then who is selling the cheap sats? It seems that it’s the short-term holders and they are not close to breaking even.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post