The Bitcoin funds turned negative but more headwinds are possible as the crypto funds flows turned negative as well which brings the total assets under management to the lowest since July 2021 so let’s read more today in our latest Bitcoin news.

In addition, both the on-chain signals and the crypto derivatives market painted a bleak picture in the near term. As per the data from the crypto investment company CoinShares, the crypto-backed investment funds lost $141 million in the capital last week which is a sharp reduction from the $274 million that was added the week before. The outflows last week came from the funds backed by BTC which saw outflows of up to $145 million. For the single-asset funds, the changes were minor with the Ethereum funds losing $0.3m and Solana adding $0.5m.

The notable exception was the so-called multi-asset funds that were backed by two or more crypto assets. The funds saw inflows of up to $9.7m with Coinshares suggesting the investors see the funds as a safer relative to the single line investment products in the volatile periods. Explaining the moves on the market, the analysts at Genesis Global Trading said that BTC is still likely to stay in the range between $29,000 and $31,000 for the next few weeks. Others however said that more downside volatility should be expected before the market moves again higher. The fundstrat Global Advisors strategist Mark Newton was quoted:

“If the S&P falls some more, that should create one final flush and a great buying opportunity for bitcoin. There’s a lot of bearishness, and we should be approaching a time when you really want to buy into that in the next couple of months.”

As Bitcoin funds turned negative, ByBit and Nansen said in the state-of-the-industry report that it is unlikely there will be a quick short term recovery in the market judging from the percentage of stablecoin held by the wallets that it said climbed in April and May after dropping in March:

“[…] the stablecoin percentage held by wallets actually climbed in relation to the declining holding percentage in March,” the report said, adding that the fall in March was “a precursor to a strong rebound within the broader crypto market.”

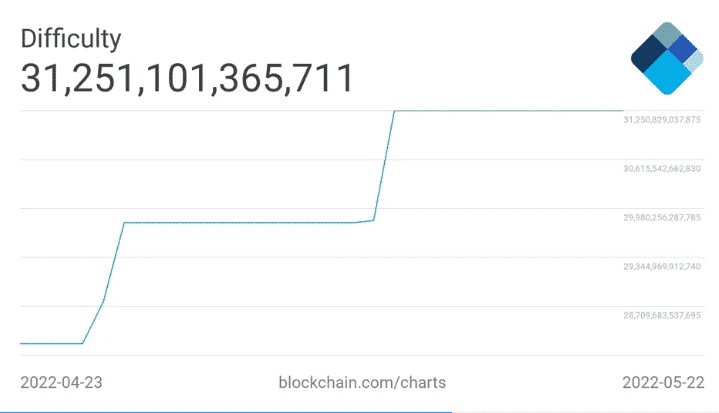

The report said that it noticed a surge in activity on the Bitcoin network since March and the spike could be because more big tech companies explore the Bitcoin Lightning Network. Glassnode wrote that BTC traded lower for eight consecutive weeks and made it the longest continuous string of red weekly candles in history.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post