The Celsius network filed S-1 form to take its mining unit public and should become effective after the SEC completes the review process which is subject to market and other conditions so let’s read more today in our latest blockchain news.

The crypto lender Celsius Network filed S-1 form to take its mining unit public with the US Securities and Exchange Commission. Without giving out too many details, Celsius Mining said the registration statement is expected to become quite effective after the SEC completed the review process as a subject to market and other conditions as per the statement. The filing came at a time when the crypto-linked stocks were tumbling alogn with the rest of the equity markets so investors hit the sell button on all asset classes amid the rising inflation and the fears of recession as well as geopolitical unrest.

Celsius Mining was active in the mining industry by investing and lending but also helping host the miners to which it will lend. Most recently, BTC miner Mawson signed a 100-megawatt co-location and $20 million debt with Celsius Mining. A year ago, Celsius Mining said it invested $500 million in the BTC mining operations in North America.

As recently reported, BlockFi settled with the regulators over the high-itnerest accounts in February so Celsius is changing its offerings as well to comply with the regulators. The US regulators are taking aim at the crypto rewards platform like Celsius and BlockFi and in the direct blow, the latter agreed to stop paying rewards to the non-accredited investors on new deposits starting on April 15. The accredited investors will be eligible for rewards still as will non-accredited customers’ assets that are held by Celius so the new rules won’t apply to the non-US customers.

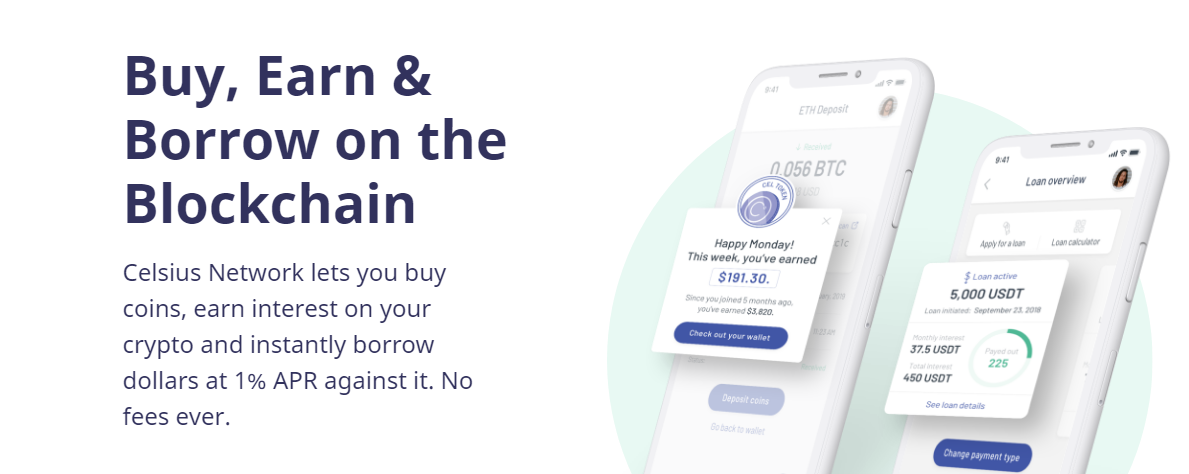

This change can dent Celisus’ business model which works in a way where customers store their crypto assets in the company and earn interest in the form of more coins and tokens. For example, Celsius now offers 7% annual returns on the stablecoins like Tether and USDT, 5% for Solana in 3% for wrapped BTC. Celsius loans these tokens out at higher rates to the borrowers.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post