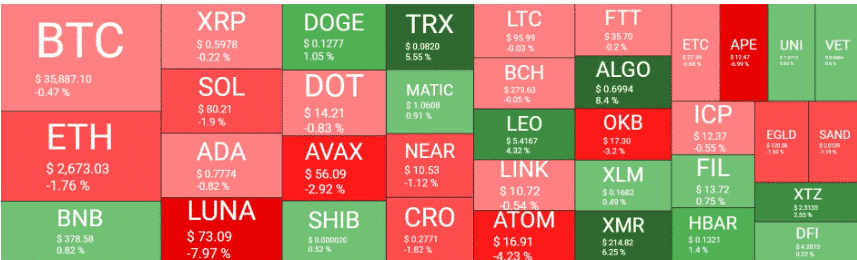

LUNA dumped 8% while Bitcoin struggles near $36K with other larger-cap altcoins making substantial price drops so let’s have a closer look at our latest altcoin news.

After the massacre a day goes by, Bitcoin slipped more and dropped to a multi-month low with most altcoins being in a similar position but Terra lost the most value on a daily scale on the other side, Monero, Algorand, and Tron charted impressive gains. It is safe to say that BTC saw better days which are nto that long ago.

buy zithromax generic buy zithromax online no prescription

The cryptocurrency hit $40,000 earlier this week near the FOMC meeting where the FED said it will raise the interest rates by 50 basis points. After dropping from this point, BTC replaced but remained close to the level in the next 24 hours but this is where the situation changed for the worse and in a matter of hours, BTC dumped by more than $4000 and crashed to a 10-week low of $35,600.

It bounced off at first and regained near $1000 but the bears kept their momentum going and pushed it south again so BTC charted another multi-month low at $35,300. as of now, the asset is trading below $36,000 and the market cap remained well below $700 billion. The alternative coins suffered just as badly and the landscape looked identical for everyone. Ethereum dropped below $2700 after a smaller decline, Solana struggled to remain above $80 while Ripple, DOT, Cardano, and Avalanche charted slight daily increases.

Terra is the biggest loser from the bigger cap altcoins as LUNA dumped 8% and trades below $75. Aside from DOGE, SHIB, and Binance Coin which are in the green, TRON gained the most and it is up by 5% sitting above $0.08. Monero and Algorand reacted well to the bloodbath with an increase of 8% and 6%. the crypto marekt cap lost around $30 billion and it is down below $1.650 trillion.

As recently reported, The Luna Foundation purchased another $1 billion in BTC or 37,863 coins which double the Guard’s precious reserves from 42,530 up to 80,394. the group facilitated the purchase by swapping $1 billion in UST stablecoin for BTC with Genesis Trading while completing a $500 million over-the-counter purchase with help from Thee Arrows Capital. The purchase brings Terra’s total reserves to more than $3 billion and the bulk of that in BTC and now holds smaller shares of LUNA, AVAX, USDC, and UST stable coins.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post