Largest coins continue falling as the losses deepen on the market as the sentiment changed in two days from bullish to bearish so let’s read more today in our latest cryptocurrency news today.

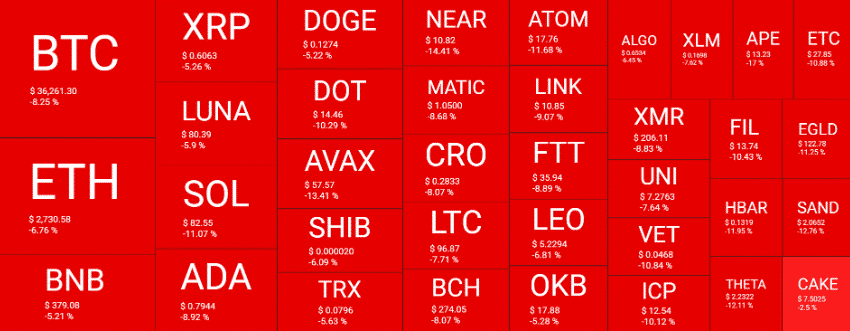

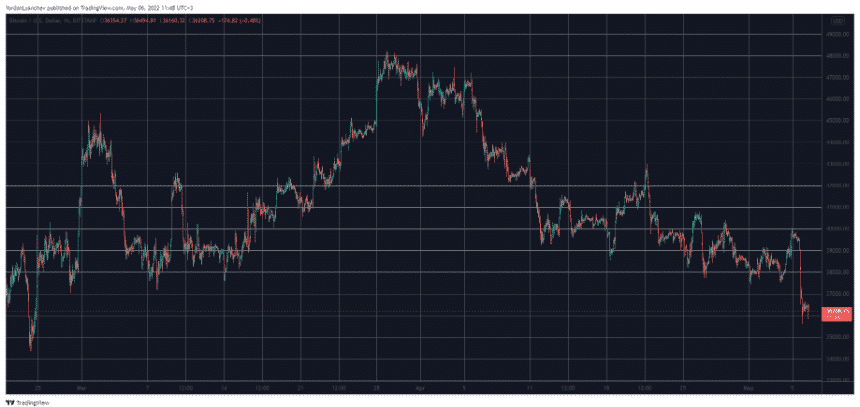

Bitcoin’s price today continued the drop until it reached the lowest point since late February however it dropped by 8% in one day and hit $36,000 before stabilizing. There’s a similar story for the market as a whole which lost 7% during the same time frame. ETH shed abou t7% and the rest of the largest coins continue falling between 5% and 9%. crypto asset prices were higher and increased along with the equities on Wednesday after the Federal Reserve announced the interest rate increase which was lower than what most traders expected. The Dow Jones Industrial Average recorded a 2.8% gain while the tech-stack Nasdaq registered a 3.2% increase.

The Dow Jones and NASDAQ both dropped by 3.1% and 5%. For the Dow Jones meant the biggest daily gain since 2020 was followed by the biggest daily loss since 2020 with the gist of the narrative is that the traders reacted with the relief a day ago that the FED inflation measures were measured before realizing today that the 0.5% point increase on the rates is still very high by the historical standards. Things are less dramatic on the crypto front which is struck by volatility.

After starting the year at $46,700, BTC moved up and down while getting back slowly above the mark. Now it is down over 21% for the year. Its losses mirrored the ones of stocks and the shares in tech companies. Google’s Alphabet is down by 20%, Microsoft lost 17% and Facebook’s Meta took a 34% drop since the start of the year.

As earlier reported, After failing the $40,000 price level a few days ago, BTC collapsed to the lowest points and dumped over $4000 in hours to the lowest price point in two months. The alternative coins are buried in the ed with a huge price drop coming from AVAX, DOT, and Solana. It was only a few days ago when the main cryptocurrency started the recovery from the recent sub-$38,000 price drop but the bulls pushed the asset north and followed the FOMC meeting where the FED said it will raise the interest rates by 50 basis points rather than 75, and BTC hit $40,000. The leg up was short-lived as BTC got stopped there and remained under the level for the next day.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post