The latest reports show that owning bitcoin beats owning COIN from Coinbase shares as the stocks crashed by 20% after the exchange’s IPO so let’s read more in today’s latest Bitcoin news.

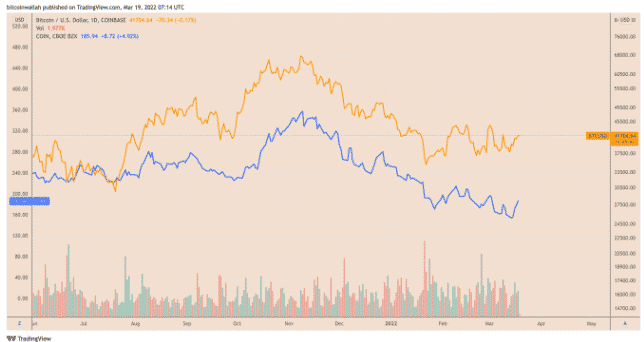

Buying a Coinbase stock to gain exposure in the BTC market has been quite a bad strategy so far compared to holding the number one cryptocurrency. COIN is down by 50% to $186 if measured from the opening rate on the initial public offering in 2021. Bitcoin outperformed the Coinbase stock by making fewer losses in the same timeframe which is a little over 30% when it dropped from $65,000 to $41,700.

With 7.5% inflation and real inflation numbers at 19.5% (shadowstats) the fed is doing a great job! Just 100x more, and they will be at Paul Volcker's level of 30% interest rates!!! Got #Bitcoin? pic.twitter.com/qesZ2iU0Mv

— Davinci Jeremie (@Davincij15) March 17, 2022

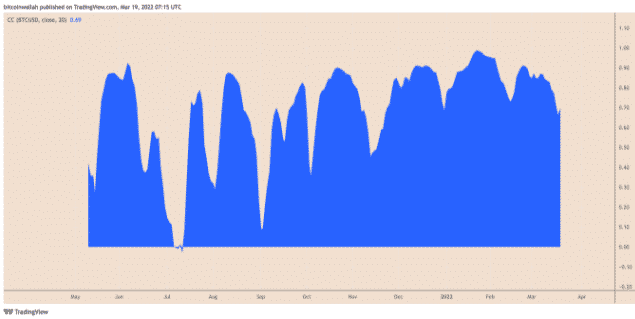

The correlation between Coinbase and BTC has been positive so far but it does suggest that many investors consider them as assets with similar value propositions. This is mainly because of the buzz around COIN and how it can create new experiences for investors in the crypto sector compared to buying BTC, ETH, or other digital assets. The COIN product is facing increasign competition with the ETFs arrival, mining stocks, and other crypto-enabled companies that are listed on the Wall Street index. This could have reduced the demand as the go-to-asset for gaining crypto exposure.

COIN still faces some downside risks due to the depressive forecast for FY22 and the exchange even stated in the earnings report that the crypto volatility can turn 2022 into an unprofitable year because of their EBITDA losses also reaching around $500 million if the monthly transaction users come at the lower end of the guidance range. The analyst at JR Research noted that 96% of Coinbase’s total revenue in the last quarter of 2021 came from the fees charged on retail tranactions which outlines the business model’s inherent weakness:

“We believe it offers a short-term buying opportunity for speculative investors. But, we do not encourage investors to hold COIN stock for the long term unless you have a very high conviction of its execution.”

Owning bitcoin beats owning COIN because BTC is a different type of asset when compared to the shares of companies like Coinbase. Absolute BTC Scarcity and gold-like properties in the digital age are just some of the concepts that drive the BTC price up today. As a result, the analysts and strategists predict BTC will reach up to a million per BTC depending on various analysts. Elsewhere, other crypto stocks have suffered more comapred to BTC and the Nasdaq-listing mining companies Canaan, its stocks dropped by 80% and Riot Blockchain dropped by 67.55%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post