Stacks price drops hard after rallying 70% in one day with a massive move upside as the $165 million funds is launched by OKCoin to create apps on the BTC blockchain using Stacks so let’s read more in today’s latest cryptocurrency news.

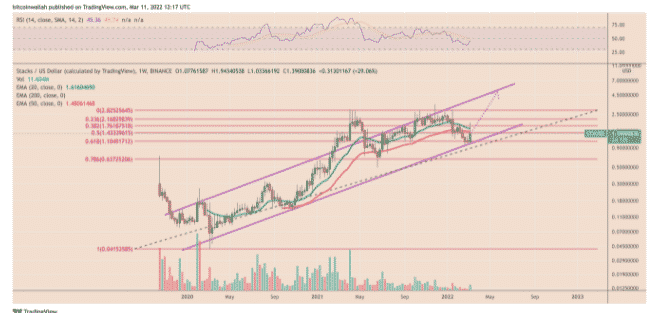

Stacks pared a portion of the gains made on March 10 as the hype around the $165 million pledge to support BTC projects showed signs of fading away. STX’s price dropped by 30% to hit a level of $1.33 when measured from the week-to-date high of $1.94. The selloff appeared technical as the $1.94 top dropped in the same range which served as solid support between October 2021 and January 2022 to flip later to become the new resistance level. It also seems that the traders spotted selling opportunities because of STX’s long wick candlestick on March 10. Stacks price drops after the ally of 30% in one day while forming a long bullish wick on the daily charts which hint upside exhaustion.

The rally on the STX market coincided with the launch of “Bitcoin Odyssey” which is a $165 million fund go t develop Web3, DEFI, and NFT projects on the BTC blockchain by harnessing the Stacks open-source network for BTC-based smart contracts. STX serves as a utility token inside the Stacks ecosystem to pay for the network activity and to contract execution. The STX owners can stake their holdings on the Stacks network via “Stacking” to support the blockchain consensus mechanism and in return, they can earn BTC rewards.

It seems that the traders flocked to buy STX and anticipated a rise in demand after the BTC Odessey launch. For example, the OKCoin exchange is the main backed behind the $160 million funds which promoted the Stacks token for the bullish outlook saying it is not a bad time to get in on Stacks. The ongoing price rally for STX appeared at a confluence of two key support levels and one of them suggests that the stacks token is headed to a new high.

The confluence comprises an upward sloping trendline which acted as an accumulation point for the traders since early 2020 and the 0.5 Fib line. STX looks to close above the two interim exponential moving averages which are the 20-week and 50-week following the rebound from the dual support area. The breakout could have the token retest another upward sloping trendline which served as a resistance level since the one in 2020. The pullback from the 20-50 EMA resistances can have the token break its ascending trendline support near $0.63.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post