Ethereum’s price risks dropping to below $2000 with a bear flag as the bearish outlook appeared against the backdrop of the FED tightening policies as we are reading more today in our latest ethereum news today.

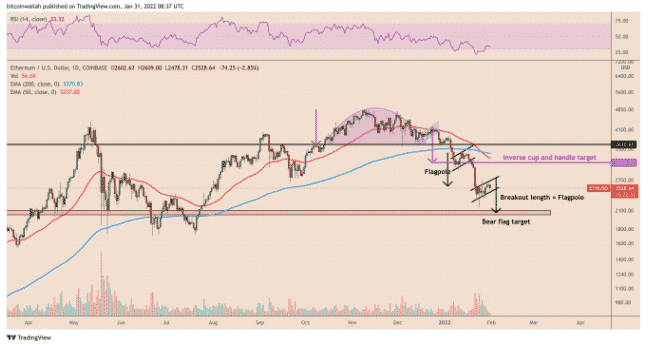

Ethereum’s price risks dropping below $2000 and will extend its 30% slump this year to the lowest price level since 2021 if a textbook technical indicator plays out. ETH’s price fell to a six-month low in January this year only to rebound dramatically to as high as $2724 days later. This created a so-called bear flag which is a chart pattern that suggests the price could drop to $2000 or a 17% drop from the previous levels. A bear flag appears when the price consolidates higher after a strong momentum downwards but it moves further lower after breaking out of the upward range and in doing so, the price tends to drop by as much as the length of the previous drop called a flagpole.

SOVs sell far, far better when there is a myth, a person and a legend to allow everyone to sell harder without really ever having to be right or wrong. Just point to the MPL. Supply & Demand is undefeated. BTC's challenge is that its 99pct SOV and 1pct monetary transfer.

— Mark Cuban (@mcuban) October 17, 2021

In Ether’s case, the crypto’s height came to be over $850 which shifts its bear flag price target towards $2000. earlier this year, another bear flag formation resulted in a similar decline. The prospect of ETH hitting $2000 in the upcoming months increases further due to BTC and its macroeconomic trends. the positive correlation between ETH and BTC has been 0.92 and Ether tailed the BTC price trends with 92% accuracy back in 2020. at the core of the bearish outlook is the FED policies as the bank decided to withdraw its $120 billion a month COVID stimulus program and to increase the benchmark rates from the near-zero levels after what started hurting the pandemic winners like tech stocks, bitcoin, and gold.

Paul Krugman, a well-known economist and long-term skeptic of crypto saw a BTC price crash in 2022 noting that it had disturbing echoes of the supreme crash in the 2008 economic crisis:

“If you ask me, regulators have made the same mistake they made on subprime: They failed to protect the public against financial products nobody understood, and many vulnerable families may end up paying the price.”

As Ether looks bearish under the shadows of BTC, most analytics anticipate that ETH will resume its climb later in 2022 and will own its involvement in the emerging DEFI space. Billionaire Mark Cuban also noted that Ether could surpass BTC in terms of growth. Mike McGlone also predicted ETH will hit $5000 in 2022:

“A top force to stop central-bank restraint is a decline in the stock market, with implications for cryptos […] Price supports exiting 2021 of about $30,000 for Bitcoin and $2,000 for Ethereum appear solid.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post