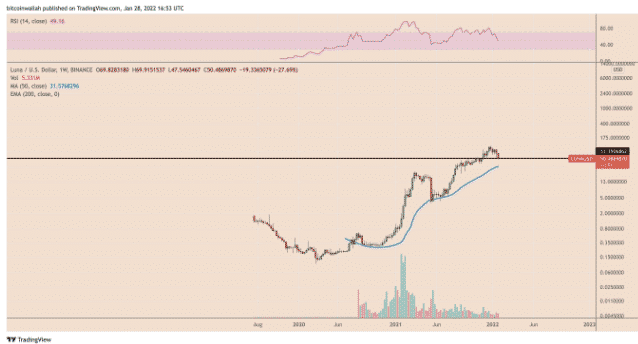

Terra’s price at risk of 50% drop as the analysts point to a possible rebound as the altcoin tests a multi-month moving average as a support line so let’s read more today in our latest altcoin news.

Terral could fall to $25 per token in the next few weeks as a head and shoulders pattern developer and indicates a 50% drop as per the technical analysis shared by CryptoPIKK. The pattern appears usually when the price forms three peaks in a row with the middle peak being higher than the two and all three come to a stop at a common price floor called the “Neckline.” The traders look to open a short position when the price breaks below this neckline but some employ a two-day rule where they wait for the breakout confirmation when the price starts retesting the neckline from the downside at resistance before it enters into a short position.

In the meantime, the ideal short target for the traders came out equal to the maximum distance between the head and the neckline. In LUNA’s case, the price has been moving towards the same H&S short target and now sits at $25. in the meantime, the volume recorded during the breaking seems consistent and underscores that the ongoing downtrend has quite a bearish sentiment which raises risks of further declines for tErra.

Terra’s price at risk of 50% drop remains while the daily momentum indicators and the RSI both entered an oversold region which some could consider being a buy signal. CRYPTOPKIK said they could prompt the price of the coin to around but also said that teh trend still needs to be heading down. The bearish outlook appears as LUNA traders remain under the pressure of a strong macroeconomic catalyst especially after the FED decision to unwind the $120 billion per month asset purchasing program followed by the increase in an interest rate hike from the near-zero levels. The monetary policies started hurting the assets which have been bullish already and the policies were loose.

This includes some sections of the US stock market and BTC and so LUNA seems to have been tailing BTC’s losses against the market uncertainty especially as it sits on top of the year-over-year profit to 3200% versus Bitcoin’s 11.50% gains. In its short history as a financial asset, Luna’s downtrends came at exhaustion testing the 50-week simple moving average as support.t the price floor was near $30 and on the daily timeframe chart, LUNA was testing the 200-day exponential moving average for another rebound.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post