Grayscale’s GBTC premium slid 30% to its all-time low as Bitcoin and the rest of the crypto market struggle with double-digit losses as we are reading more in today’s Bitcoin latest news.

As the crypto market continues to fall in the past few days, Grayscale’s GBTC premium continued falling and reached a new all-time low. According to the data from Coinglass, the trust’s negative premium reached an all-time low as BTC has a hard time around the $35,000 price point. The GBTC has been trading on a decline since February last year with the premium now sitting at 30%.

The Grayscale Bitcoin trust is an investment vehicle that is provided by Grayscale Investmetns as one of the biggest managers for institutions venturing into the crypto space. The GBTC fund allows investors to gain bigger exposure to BTC through a regulated traditional investment vehicle without having to directly buy and sell or store the asset. Each GBTC share represents 0.00095 BTC and tracks bitcoin’s market price. The shares have a minimum holding period of six months and a minimum investment level of $50,000 making it quite hard for retail investors to join.

With the recent decline in institutional demand for crypto, the shares of the Trust premium traded at a steep discount. The premium represents the difference between the price of the asset and Bitcoin in this case as well as the Trust’s shares. The latest plunge in premium discounts can be attributed to a few factors including the launch of a few spot exchange-traded funds, providing institutional investors with an alternative to invest in BTC via a regulated stock market vehicle.

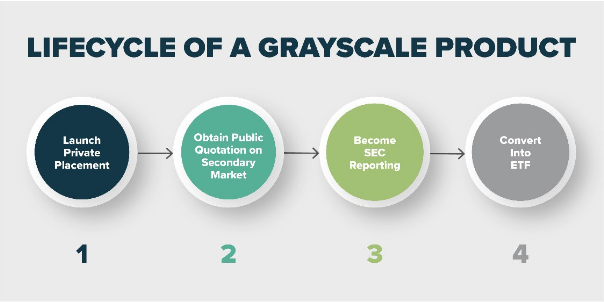

Grayscale filed to turn its BTC Trust into a spot BTC ETF which will be backed by actual units of digital assets and not just being linked to it through the derivatives contracts.

buy finasteride online gilbertroaddental.com/wp-content/themes/twentyseventeen/inc/en/finasteride.html no prescription

However, the US SEC still hasn’t shown any signs of approving a spot Bitcoin ETF due to regulatory concerns. A few days ago, First Trust and SkyBridge BTC trust got rejected for their ETF application by the SEC.

Just a few days ago, The Grayscale BTC trust registers record discounts after being a long-term investment tool of choice for a lot of institutional investors that offer exposure to BTC without the need to buy the actual asset. It comes with a few drawbacks like the annual management fee of 2% and the six-month lockup period.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post