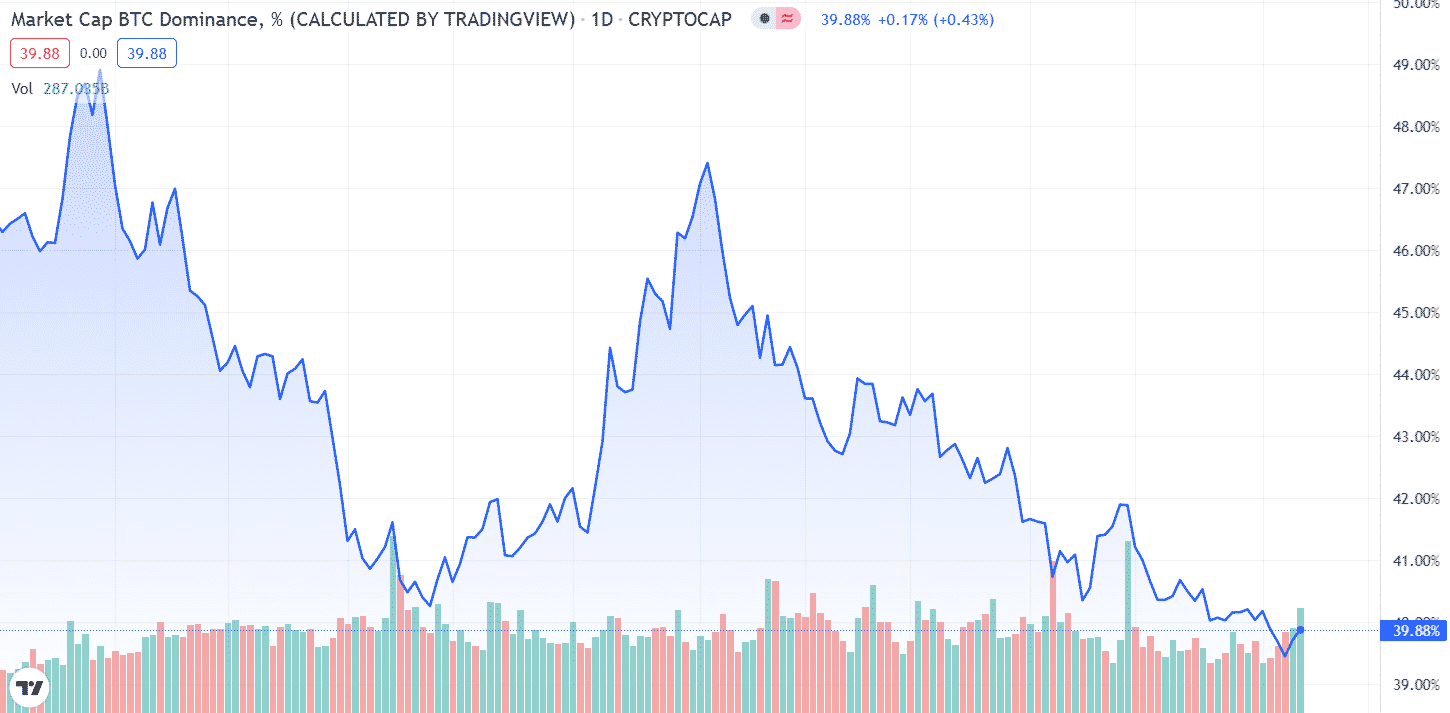

Bitcoin’s market dominance reached lowest level since 2018 at 37.28% as it continues to sink with investors looking at other cryptos so let’s read more today in our latest Bitcoin news.

Bitcoin’s market dominance reached lowest level since 2018 and it stands at 37.28% and the last time it was this low was back in 2018 during the harsh bear market when it dipped to as low as 33%. Market dominance refers to a crypto’s share of total market cap with the entire crypt market cap now standing at $2.3 trillion. Bitcoin’s market cap is now set at $871 billion, below the November $1.27 trillion. The reason for the larger drop is quite simple: investors are looking at other coins as one crypto trader and analysts noted, that there’s little demand for Bitcoin from the retail investors at the moment.

Retail investors are not interested in Bitcoin because it is not that type of investment that the newcomers on the market will get rich from. The institutional buyers like MicroStrategy, TEsla, or Square could benefit more from larger Bitcoin purchases as hedge against US dollar inflation. Altcoins however are more attractive investments for those that want bigger gains. For example, the meme coin Safemoon that some see as a Ponzi scheme is up by 68% in the past week. In fact, the best performing cryptocurrency in 2021 was not Bitcoin. Investors looked to meme coins like DOGE and Shiba Inu that surged 42,349 and the rising value of the coins helped explain Bitcoin’s dropping market share.

The growth of the decentralized space and NFT markets also helped to spur the rise of competing cryptocurrencies. DeFi refers to projects that automate bank-like services and NFTs that became popular among celebrity collectors which are making it easy to buy and sell art and music via blockchain networks. Both NFTs and Defi run on Ethereum largely. ETH is the second biggest crypto by market cap with a market dominance of 19.27% and its dominance has been on the rise since Q4 with investors getting more interested in Defi and NFTs. The growth of the markets helps to explain the rise of Solana that competes with Ethereum. The price of SOL increased by more than11,000 in 2021 and became the fifth-biggest digital asset by market cap.

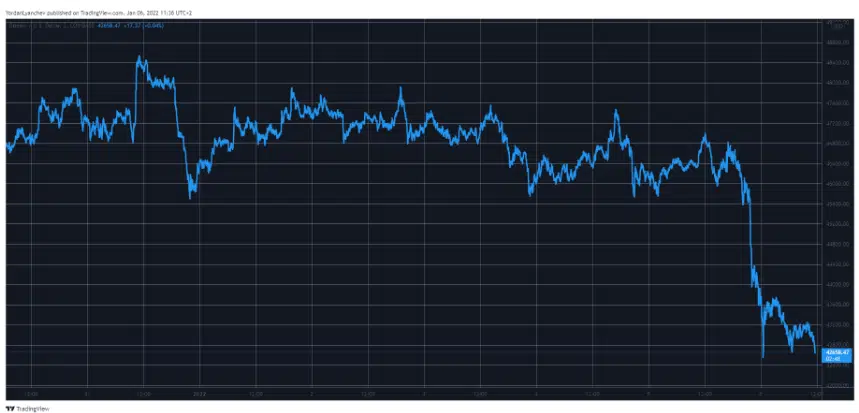

Both BTC and ETH led sluggish starts to 2022 in terms of price as the two biggest digital assets are down by 33.7% and 23.6% respectively from their all-time highs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post