Crypto companies spent $5 million in lobbying in the Senate so they can stabilize their position in Washington with the top firms spending the most in the first three quarters of the year as we can see more in today’s crypto news.

According to a report by The Economics, during the first nine months of 2021, the crypto companies spent $5 million lobbying in the United States Senate, and half of it was spent during the first three quarters which only shows that the amount poured in surpasses the one for the same period a year ago by four times. Coinbase was one of the biggest supporters of the cause and it spent $625,000 in Q3 while Jack Dorsey’s Square spent over $1.7 milion since April last year.

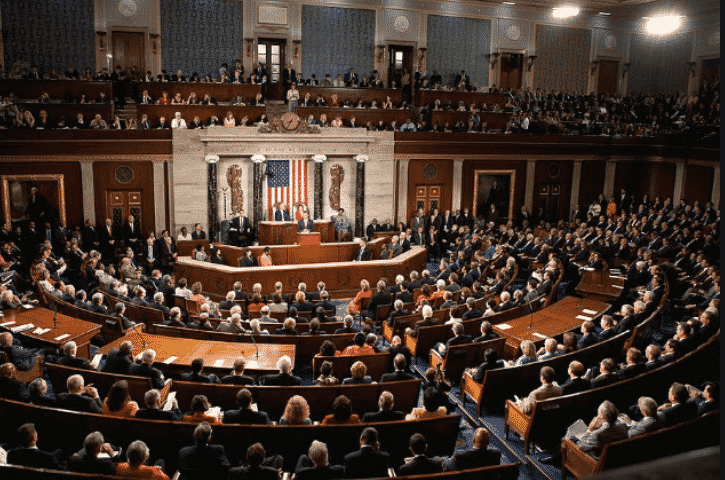

The top executives from Coinbase, FTX, Circle, and others appeared before members of Congress to make the case for the growing importance of crypto and crypto regulation in a five-hour hearing. Some in Washington started to hold crypto themselves like Cynthia Lummis, a senator from Wyoming that holds between $100,000 and $250,000 in BTC as well as other four Republicans that hold investments in crypto as well.

Such crypto adoption could indicate a change of heart in Washington but the regulations are showing a much more different picture. Joe Biden approved a $1.2 trillion infrastructure bill that incorporates custodial crypto services such as Binance and Coinbase into the legislative definition of a broker which means these companies can provide the federal government with 1099 forms listing names and addresses of the ones that transact in crypto. Indian regulators on the other hand had a harsh relationship with the industry for example.

Back in 2018, the Reserve Bank of India issued a ban on banks that deal with crypto. However, it was overturned in March this year by the country’s supreme court. However, the RBI insisted that they are anti-crypto. Turkey’s central bank banned crypto payments as well despite the country having some of the biggest crypto usages in the world. Three payments companies in China reiterated their support from the 2017 ban on financial intuition that transacts in crypto. China also started a harsh crackdown recently on crypto mining operations within the nation.

Given the fact that Germany’s latest coalition government expects crypto to be pivotal to the technological and economic development because the EU is also drafting a regulatory framework for crypto, it is looking like twin western superstates of the EU and US will take another approach towards crypto and it seems that all that lobbying has to be working.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post