Bitcoin entered December as scarred as can be because of the extreme volatility that we witnessed recently. Now, the market entered into the last month of the year with severe losses but will we see a strong ending of 2021? Let’s find out in today’s bitcoin news.

The extreme volatility that the crypto industry experienced at the end of November was enhanced by the huge liquidations in the futures market and according to the data from Glassnode, BTC crashed from its high of $59,000 to a low of $45,000 during the weekend which puts the market down by 35% from the all-time high at the start of the month. The new COVID-19 variant and the FED rumors only pushed Bitcoin further into the red.

After rising to $60,000, BTC took a huge hit last week when the market entered into the deep red. The huge shakedown was not really contained to the crypto industry alone as the global financial markets took a hit as well with the stock prices on exchanges seeing major drops. A driving force for the market, BTC crashed to a low of $45,000 on Sunday after rallying to a high of $59,000 with a 35% decrease from the ATH that was set at the start of November dragging the rest of the market down with every crypto showing major losses.

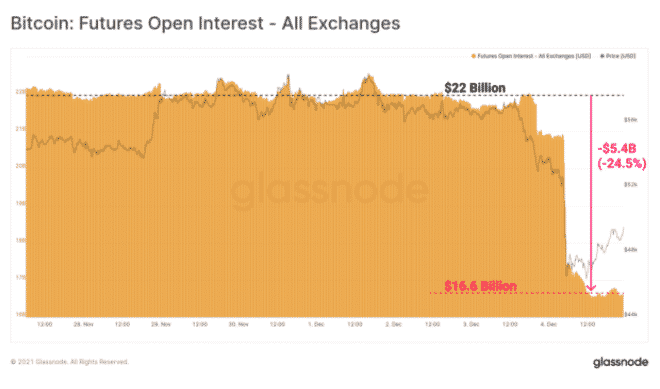

The extreme volatility was caused by panic selling as the traders raced to the market and last week we saw the FED chair Jerome Powell indicating that the central bank considering reducing the pace of the monthly bond buys which could enable the FED to raise interest rates in the upcoming spring. This only added fuel to the fire that was ignited by the emergent strain of the COVID pandemic. The sell-off was caused by the rumors of the liquidations of the market and according to the data by Glassnode, the sustained peak levels of open interest in the BTC futures markets only created a foundation for high volatility events. As the weakness in legacy markets pushed the assets underwater, the Bitcoin selling pressure launched a cascade of liquidations. Walid Koudmani who is an analyst at XTB said:

“While the cryptocurrency market is known for its volatility and potential price spikes, the correction experienced this weekend appeared to shake confidence in the market as a whole. Today the situation appears quite uncertain as BTC trades around $47,000 and as investors focus on headlines to ascertain the severity of the matter.”

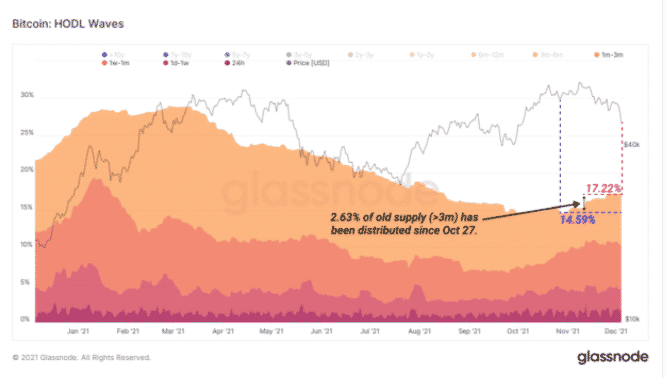

Bitcoin entered December scarred but most tokens were also dumped at spot markets that belonged to new investors. Glassnode reports show that 97% of BTC’s supply older than 3 months remained unspent. But if you want to check the value of Bitcoin, make sure to check out our Bitcoin price calculator on our website.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post