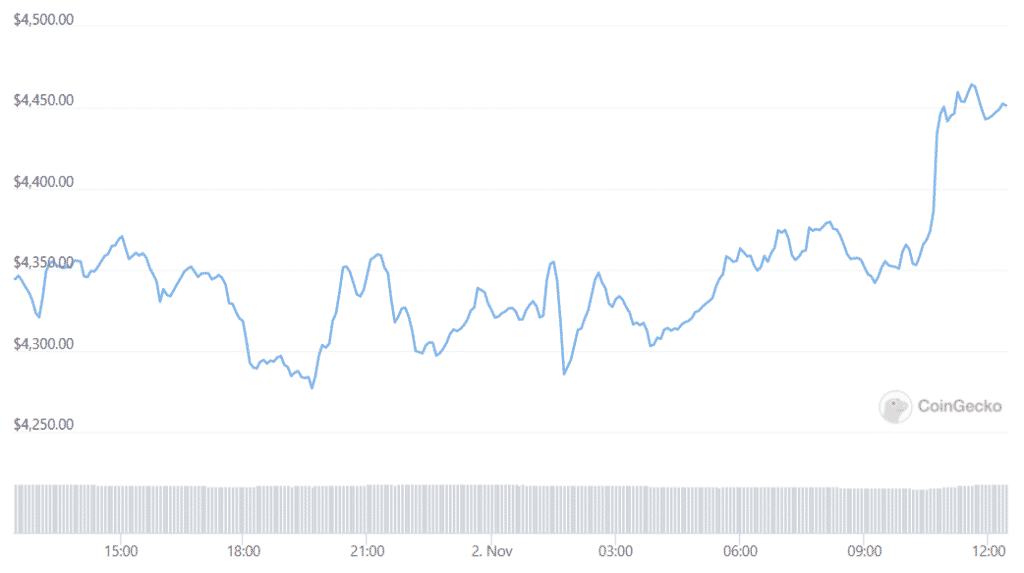

An ethereum net deflationary week just happened for the first time ever and the community saw this as a beneficial event from a monetary standpoint as we can see more in today’s Ethereum news.

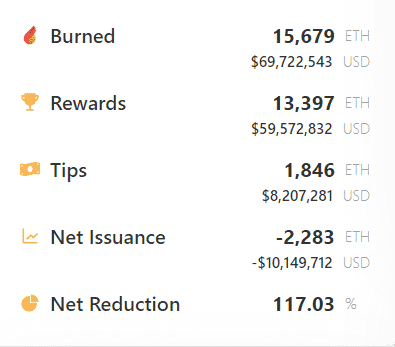

With Ethereum’s London Hard fork being in full effect, the network was burned ETH for three months but in the past week, more ETH Was burned on the platform than it was generated which resulted in an Ethereum net deflationary week for the first time. According to the data from Watch the Burn, over 100,000 ETH was burned in the past week and only 93,000 ETH was issued in the same time frame as block rewards to miners which put the total net issuance of Ether at about negative 8600 or around $37 million. The network experienced its first day of net-negative issuance in September.

The immense value was removed from Ethereum since the London hard fork and in a month, over $1 billion in ETH were burned in transaction fees that would have been used to reward the network miners. Today, these miner rewards are issued as an optional “tip” by the network users. However, the funds generated from the tips are only a fraction of the rewards and in the past day, less than 14 thousand ETH were distributed in tips to miners which is why Sparkpool as the biggest ETH mining pool opposed the EIP 1559 when it was initially introduced.

According to Tokenview, some of the projects responsible for the burn include Parallel, Fat Ape NFT, Xrune, and others, apart from the usual suspects like OpenSea, Uniswap, and USDC. Watch the Burn also showed a net reduction percentage that shows how much ETH issuance has been reduced since the EIP-1559 introduction which is over 100% on the week as another indicator that shows more ETH being burned than minted. The site also shows that this phenomenon is a good thing and called Ether “ultra-sound money.”

Many ETH supporters made the claim as well following the London Hard fork. ConsenSys founder Joe Lubin even noted that the upgrade was turning Ether into ultra-sound money and the founder of Week in Ethereum News Evan Van Ness, mocked BTC for being unable to reduce supply in the same manner.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post