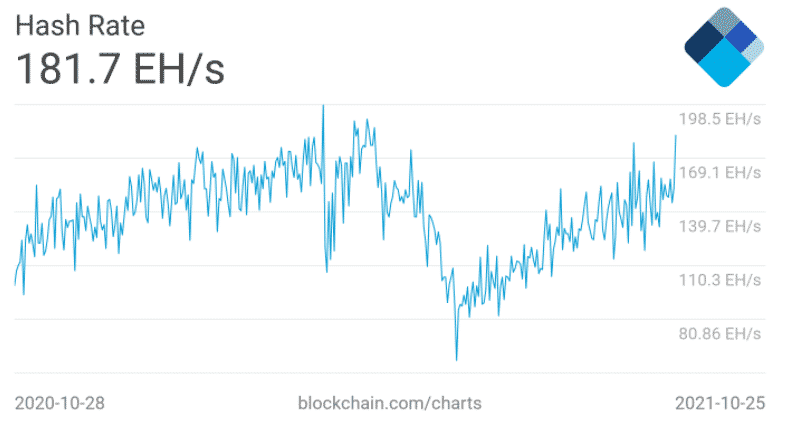

The latest BTC hash rate removes the traces of China’s mining ban because the network fundamentals are taking care of their own recovery as we can see more in our latest Bitcoin news today.

Bitcoin deleted the traces of the mining ban which saw the hash rate drop by 50% with the latest BTC hash rate increasing and getting to levels seen in May. Five months since the biggest ever migration of BTC history started, the network fundamentals staged a huge comeback. Coming in bounds as the miners relocated, the recovery in hash rate and network difficulty is approaching a seminal point. While impossible to measure the definitive terms, the hash rate accounted for the entire China debacle and doubled from its bottom a few months ago.

Miner Revenue ➗Hash Rate:

This shows the cost to produce a marginal unit of BTC per hash.

Testing blue trendlines as resistance has coincided with peaks in price.

Will we see something similar again? pic.twitter.com/La1UbNxTL5

— Nunya Bizniz (@Pladizow) October 27, 2021

Likewise, the mining difficulty is set to increase by 5.7% next week and brought it within 4 million of the 25 trillion record high. Bitcoin also will seal its eight straight difficulty increase which is the first time this event occurred in 2018. Charles Edwards the founder of investment company Capriole wrote:

“Hash rate has only been higher than today on just 6 other days in history. We are knocking on new all-time highs in network security. That’s kind of unbelievable.”

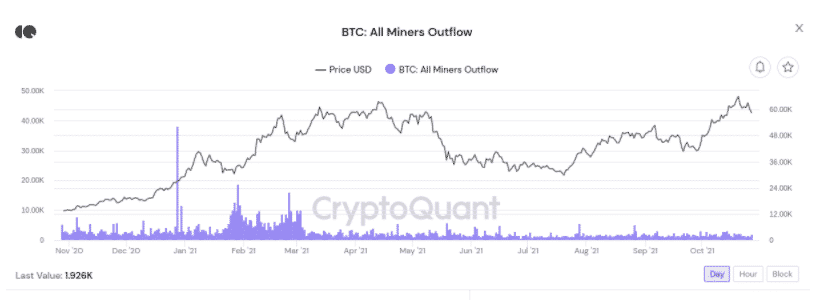

Bitcoin gained 50% since May while the sources hinted that China could be starting to regret its decisions. In the meantime, other data analysts questioned the sustainability of the current BTC price action and it came after BTC/USD dipped to $58,000 with figures covering miner costs that point to the local top based on the historical patterns. The miners were in no hurry to sell these earned coins in recent months which is a trend that goes on.

As recently reported, The effects of China’s ban on crypto Are profound as the new data shows that more than 20 crypto companies were forced to leave the country or suspend their services to Chinese users. According to the reports from China Securities Journal, the crypto companies that were forced to close operations include exchanges like HuoCoin, BIKI, BHEX, Binance, and more. More than 20 virtual currency-related companies announced that they will stop providing relevant services for users in China and will withdraw from the Chinese market entirely.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post