NYAG announces further investigation for the unregistered crypto lending platforms and Letitia James even ordered these platforms to stop operating so let’s find out more in our latest cryptocurrency news.

Letitia James, New York Attorney General-NYAG announces further investigations for unregistered crypto lending platforms and urged all platforms to cease all operations while demanding that three others hand over information about all of their operations to the office. James said:

“Cryptocurrency platforms must follow the law, just like everyone else, which is why we are now directing two crypto companies to shut down and forcing three more to answer questions immediately.”

The New York Attorney General didn’t name the crypto lenders and the names of companies but one of the letters issued bears the filename “Nexo Letter” while the other is called “Celsius Letter” only suggesting that Nexo and Celsius Network are two of the companies being targeted by the NYAG. Right now, it remains unclear whether these crypto lenders are indeed being investigated. A spokesperson for Nexo said:

“Nexo is not offering its Earn Product and Exchange in New York, so it makes little sense to be receiving a C&D for something we are not offering in NY anyway. But we will engage with the NY AG as this is a clear case of mixing up the letter’s recipients. We use IP-based geoblocking.”

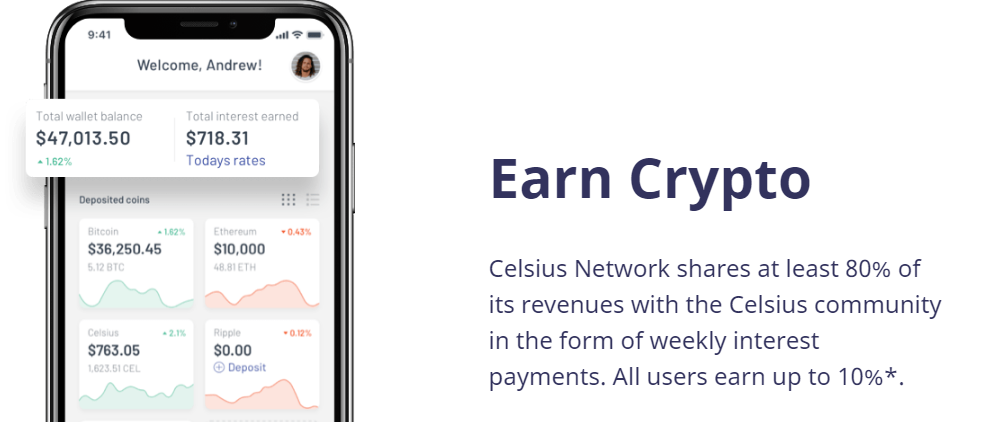

The NYAG said that the “virtual currency lending products at issue in today’s actions promise a rate of return to investors and claim to deliver these returns by among other things, trading with or further lending the virtual assets.” The NYAG said that these platform offers interest-bearing accounts and fall into the category of securities as per the New York Martin Act. Passed in 1921, this act gives the NYAG broad power to investigate alleged securities fraud. The latest announcement shows that these companies offered securities without first being registered with the office of the Attorney General.

Both Celsius and BlockFi, the most popular borrowing services, were hit hard with the recent regulatory crackdowns. The state of Kentucky’s financial regulator barred Celsius from selling the interest accounts in the state. The regulators in this state claim Celsius’s interest accounts are securities products and have to be registered as such. Alabama and New Jersey as well filed cease and desist orders against Celsius while the Texas State Securities Board ordered Celsius to appear for an administrative hearing in February. BlockFi faced challenges as well with the regulators in Vermont, Texas, and Kentucky all filing cease and desist orders against the company. Alabama issued a show cause order against BlockFi too.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post