Bitcoin returns to $55,000 for the first time since May, since Elon Musk decided to stop allowing Tesla purchases in BTC so let’s read more in our latest Bitcoin news today.

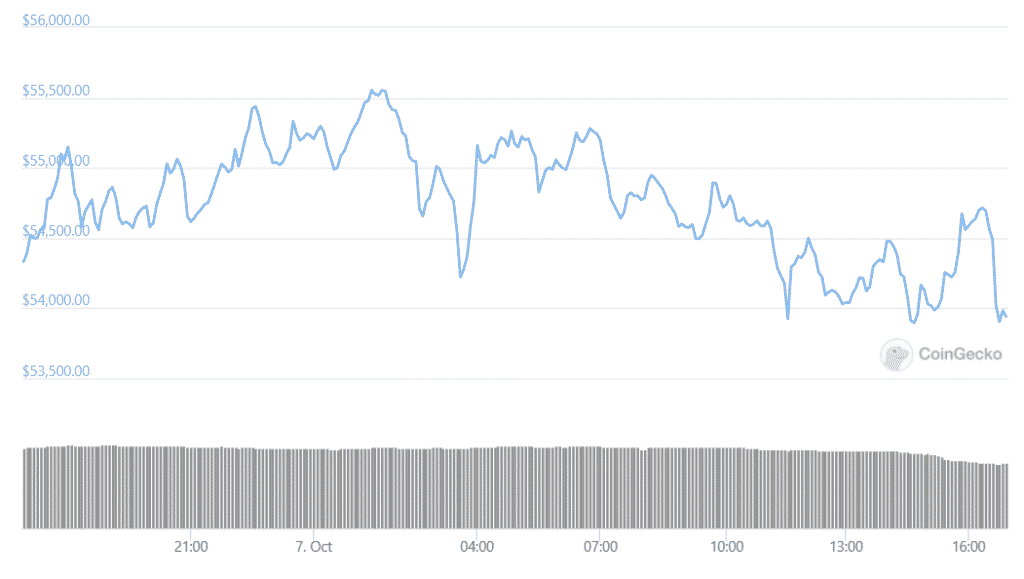

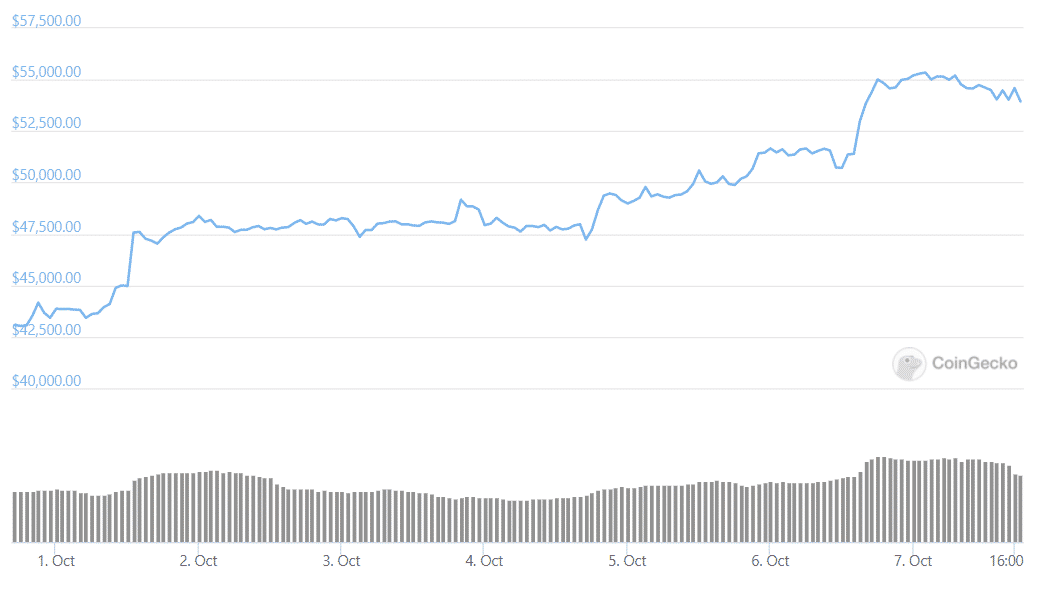

Bitcoin returns to $55,000 for the first time since May as the October boom continues. The biggest crypto by market cap peaked at $55,530 on CoinGecko a few moments before falling back to its current price of under $54,000. if the uptrend continues, we can see Bitcoin crush the $55K price range which was once achieved but when Elon Musk announced that his company won’t accept payments in BTC, the coin crashed.

The news sent Bitcoin into a downtrend spiral which was exacerbated by the Chinese crackdown on BTC mining the following month with the cryptocurrency bottoming out under $30,000 in mid-June. In the past few days, Bitcoin’s price recovered after the comments by Federal Reserve chair Jerome Powell that the US has no intention of following China in banning crypto. But even before that, BTC’s price showed signs of shrugging off the summer sentiment.

The announcement by teh Chinese government reiterated that crypto-related businesses activities are illegal and have a short-term impact on the price of BTC. With the Chinese miners relocating their operations across teh world, the new mining operations springing up the US and somewhere else with the mining revenue reaching $40 million per day in October. The crypto privacy advocate Edward Snowden said that the decision by the Chinese governemnt, only made Bitcoin stronger.

As recently reported, The price of BTC is surging and some are putting it down to the imminent BTC ETF approval from the SEC. The Bitcoin ETF is an investment product that allows investors to buy shares that represent the digital asset without having to deal with teh crypto themselves. An ETF doesn’t exist yet in the US because the SEC rejected applications for the product, citing concerns of price manipulation on the market. The industry has longed for a Bitcoin ETF to be approved and the expectation is that when one does happen, it will lead to a huge flow of institutional money on the market and will push the price of BTC even higher.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post