Solana futures open interest hits $1 billion with the native token reaching a short-term top as the price swing liquidated the leveraged longs with the data suggesting that this top is not a bearish trend reversal so let’s read more in our latest altcoin news today.

Solana reached a $216 ATH after rallying 508% since August and the bull run caused analysts to project a $500 target which will translate to a $150 billion market cap. It is worth noting that during Solana’s rally, the ETH network average transaction ee surpassed $40 and the interest in the NFT market only sped up the investors’ transition to Solana which was eventually boosted by the FTX NFT marketplace.

The above charts showed that the SOL two-month performance compared to AVAX and Cosmos are both fighting for a decentralized application user-base and offer fast and cheap transactions compared to ETH. Most players in the industry invested in Solana’s ecosystem due to the potential against ETH. Andreessen Horowitz and Polychain Capital led a $314 million funding round in Solana Labs which was funded by the venture capital company Andreessen Horowitz, Alameda Research, and Polychain Capital.

During the SALT Conference 2021, Solana founder and CEO Anatoly Yakovenko said that the network is optimized for a specific use case like an online central limit order book, a trading method that is used by exchanges that match bids with eh offers and it was designed for the market makers that need to submit millions of transactions per day. Yakovenko added:

“There are Pareto efficiency tradeoffs. If I optimize for hash power security, that means I can’t have a lot of TPS. You have to pick one or the other.”

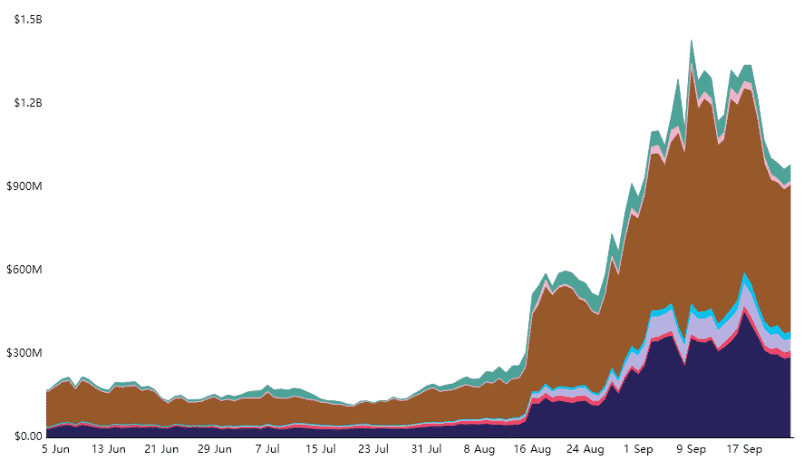

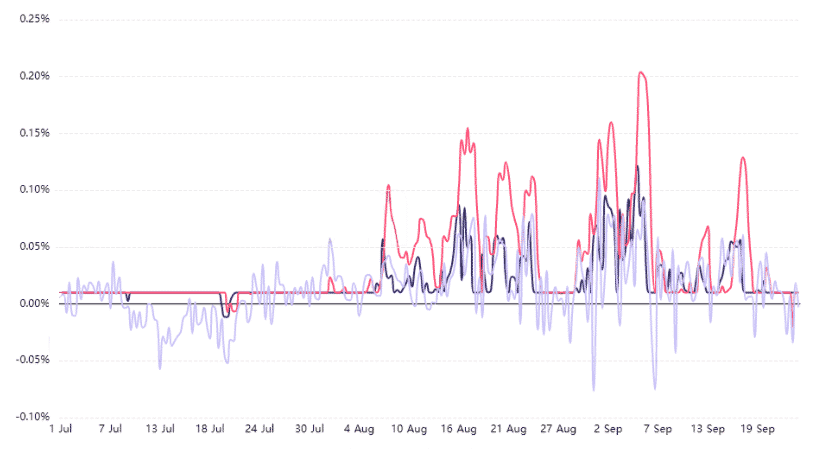

The Solana network experienced an outage recently that lasted 12 hours. The team explained that the large increase in transaction load to 400,000 per second overwhelemd the network and created a denial of service which caused validators to fork. The Solana futures open interest hit $1 billion despite the recent setback. This figure makes Solana’s market the third-biggest behind BTC and ETH. Teh data confirms investors’ interest but it can’t be deemed bullish because of the futures buyers and sellers matched at times. As an answer to the question, one has to analyze the funding rate. The perpetual contracts known as inverse waps have an embedded rate that is charged every eight hours and this fee ensures that there are no exchange risk imbalances. However, an opposite situation happens when the short-sellers require additional leverage and causes the funding rate to go negative.

The data shows no evidence of the investors rushing to add more leveraged long positions with the current $1 billion open interest. Considering the 410% gain in the past two months, the traders have plenty of reasons to fear a downside because BTC also failed to break the $50,000 psychological barrier and has yet to confirm if this tip was short-termed.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post