SushiSwap avoided a $350 million defi hack just a while ago and it would have joined the club of attacked platforms like Poly Network which lost $600 million but it didn’t so let’s see how and why in today’s crypto news.

Sushiswap avoided a $350 million DeFi Hack but a white hat hacker saved the day. Samczsun who is a Paradigm researcher shared the report and according to him, the investigation on teh smart contract code for the BitDAO Token sale started on August 17th. The sale took place on the SushiSwap MISO platform which is a place where developers are able to launch their new tokens and this time it was also successful so the project raised $365 million without any issues. They however could have lost everything to hackers due to the smart contract code error.

buy stromectol online www.mobleymd.com/wp-content/languages/new/stromectol.html no prescription

Smart contracts are codes that perform different instructions on the blockchain and these codes are important because they ensure the proper functioning of the Dapps on the blockchain. After discussing the issue with Sushiswap and Immunefi representatives, they decided that the sale will have to be stopped and they will fix the bug that way. Based on the information, sushiSwap disclosed that they didn’t lose any funds to the attackers but the team stated that the sale will temporarily enable them to update the codes and the protocol is now very popular so this could have disappointed the buyers slightly.

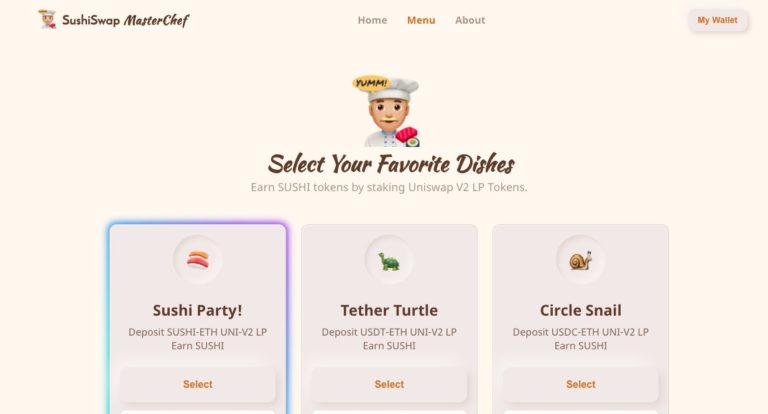

SushiSwap recorded a total of $444 million in trading volume and with the users making a lot of returns by staking in the liquidity pools as well. The protocol went live in 2020 as a Uniswap copycat but it then made a name after launching the native token SUSHI. The protocol avoided a heavy exploit which will have set it back thanks to eh white hat hacker.

As recently reported, The DEX allows users to swap, trade, and lend assets via a non-custodian trustless platform where the traders are matched via a smart contract. The users can stake their tokens on the protocol in different trading pairs in order to earn yield from the fees generated by other traders on the DEX. Now things are going up a notch. Kashi is the first margin trading platform that is built on BentoBox and will allow traders to borrow funds from the protocol to place higher bets on assets. It will allow users to go short or bet against assets as BentoBox is a crypto token vault that generates yields from flash loans and strategies of its framework.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post