Bitcoin dives below $30K for the first time in a month after trading sideways for weeks as we can see in today’s Bitcoin price news today.

Bitcoin dives below $30K for the first time in a few weeks after trading sideways and multiple indicators including the lower demand, Grayscale unlocking GBTC shares, and renewed regulatory attention could have contributed to a new bearish impulse. BTC is now trading at $29,766 the crypto’s lowest amount since June 22 and over the past week, Bitcoin’s price dropped by 10%. a few market indicators from around the web unpack some of the latest price action today.

JP Morgan is bearish on the GBTC unlock coming up.

Here I'll go through the inner workings so you can make up your own mind.

There's 2 impacts, one bullish, one bearish. The key is in how they interact. IMO it'll be immediately bullish.https://t.co/xcfMbhCBPP

— Willy Woo (@woonomic) July 6, 2021

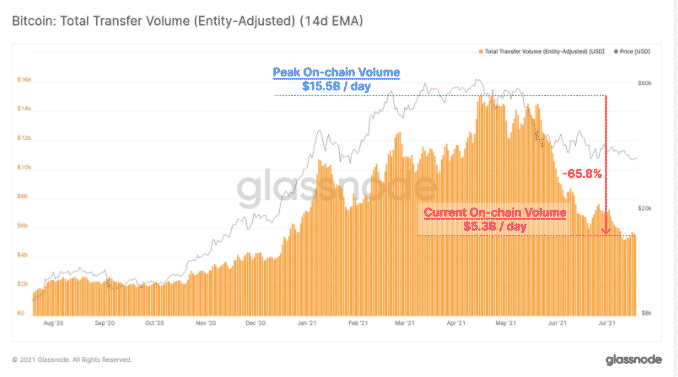

For one, there is far less demand for BTC these days than it did back in April or May so when the broader market only went up, the network started settling a third of the money compared to then as per the data aggregator Glassnode. The Grayscale Bitcoin trust started unlocking shares onto the market and it is expected that Grayscale will unlock about 31,900 GBTC shares this month. GBTC shares attempted to trace the price action of the leading cryptocurrency and it’s the structure of the shares that some pundits said create strong volatility in BTC.

The wealthy investors are offered private placements for GBTC after which they give Grayscale BTC or dollars for an equivalent amount of GBTC. Each share equals about .001 BTC and these shares can be sold on any secondary market like Interactive Brokers and Fidelity. The holders of the shares can’t actually sell their newly minted GBTC until a six-month period elapsed. The wait time hasn’t been a problem as GBTC almost always traded at a premium above its underlying asset and allow minters to pocket a huge sum at the end of the six months. The premium has become known as the grayscale Premium and was one of the market’s shoo-in trades. It also became a proxy for broader institutional interest in BTC and the traditional investors and hedge funds are uncomfortable with holding crypto on their books or they are simply not allowed. GBTC offers a workaround of this while still offering a similar price exposure as Cathie Wood’s ARK invest for example bought up heads of the product in 2021.

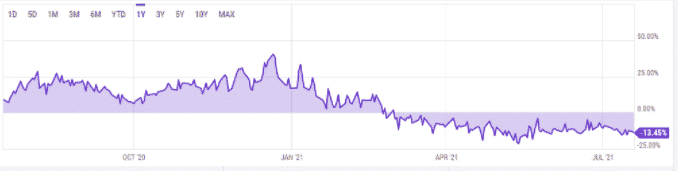

These days, the trade is far less interesting as the premium dried up and a 13.45% discount took its place. This means it is cheaper to buy GBTC than it is BTC. This should be taken with a little skepticism and it is still a matter of debate whether these unlocking events are bearish or bullish. These events are expected to bring volatility to the market.

buy kamagra soft online pavg.net/wp-content/themes/twentytwentyone/inc/en/kamagra-soft.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post