Ethereum tumbled below $2K with its key indicators suggesting that more pain is on the horizon as we can see more in our latest Ethereum news.

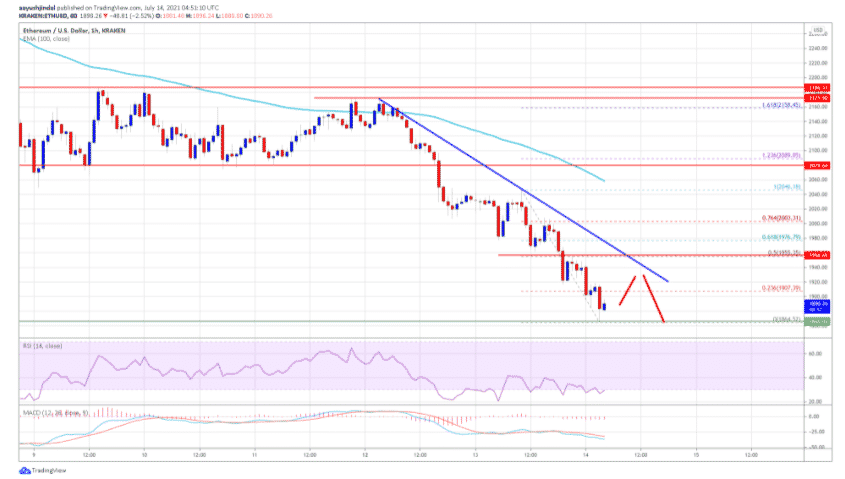

Ethereum’s price is showing bearish signs and remains at further risks of downsides below $1800. The price is now trading below the $2000 resistnace and the 100 hourly simple moving average with the key bearish trend line forming with the resistnace near $1940 on the hourly charts of the pair. The pair will continue to lower below the $1850 and the $1820 support levels as ETH dives by 8%.

There’s no major recovery in ETH above the $2100 level similar to BTC and as a result, ETH saw another drop and broke the main $2000 support zone. The price was able to gain pace below the $1950 support and settled below the 100 hourly simple moving average so a new low was formed near $1864 and the price is now consolidating the losses. The initial resistnace on the upside is close to the $1910 level. Ethereum tumbled below $2K as the 23.6% fib retracement level from the recent drop of the $2046 high to $1864 low is near the $1910. Besides, there’s a key bearish trend line forming with the resistance near $1940 on the hourly chart of the pair.

The trend line resistance is close to the 50% fib retracement level of the recent decrease to the $1864 low. The main resistance sits near the $2000 level and a close above this zone could set the pace for a larger increase in the near term with the next major resistance nearing the $2075. if Etheruem fails to recover above $1910 and the $1950 it will continue to move down as the initial support on the downside is near the $1850 level.

A new downside break below the $1850 support could spark more losses and the first major support is near the $1800 level. If Ether fails to stay above the $1800 support, it could drop to $1750 swing support and more losses could lead the price to the $1680 support zone in the upcoming sessions. The hourly MACD for the pair is gaining pace in the bearish zone while the hourly RSI is well below the 50 levels.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post