Synthetix Rises 26% as other Defi tokens started seeing major gains compared to the rest of the crypto market with SNX leading the way as we can see more in our latest altcoin news today.

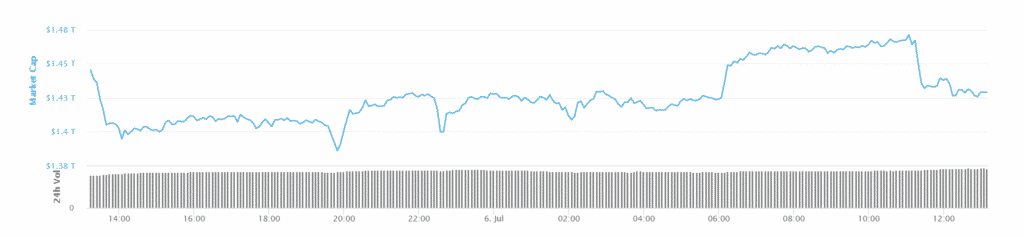

Decentralized finance tokens are seeing major gains compared to the rest of the market while Synthetix rises 26% leading the parade so far. SNX is up 26.8% over the past 24 hours and now trading around $12 according to CoinGecko. Last week, SNX developers reported a monthly trading volume growth on the platform that totaled 15% of the total volume in 30 days. Synthetix tweeted:

“In a single month, Synthetix hit roughly one billion in Synth trading volume. That’s 15% of our total tracked volume, 6.75 Billion, in one month! This is a major milestone as it reflects the tangible growth happening to the protocol. Exciting times.”

In a single month, Synthetix hit roughly one billion in Synth trading volume.

That's 15% of our total tracked volume, 6.75 Billion, in one month!

This is a major milestone as it reflects the tangible growth happening to the protocol. Exciting times. https://t.co/aQ1m68A0Us pic.twitter.com/iWcCI02XiI

— Synthetix ⚔️ (@synthetix_io) June 30, 2021

DeFi is a huge ecosystem of interconnected blockchain protocols like lending platforms, DEXs, and liquidity pools which allow users to act as replacements for traditional banks. Synthetix as well as other Defi tokens posted double-digit gains in the past 24 hours. They include Ethereum-based COMP with an increase of 14.9% and SUSHI with 14.8% gainst. UNI increased by 6.2% on the day and traded around $21.71. Other Defi tokens rallied as well with ThorCHAIN increasing by 13.5%, AVAX by 9.9%, CRV 6.8%, and binance Smart Chain CAKE token increased by 6.2%. In the meantime, data provided by DeFi Pulse shows that there is $54 billion in value locked on various Defi platforms. The top five spots were taken by Aave that has $11.23 billion locked, Curve Finance with $8.51 billion, Compound $7.08 billion, and Maker $7.19 billion.

At the same time, most of the non-Defi cryptocurrencies remained locked in their narrow price corridors, and Bitcoin for example decreased by 1.4%, Ethereum by 1.5%, and ADA by 0.8%, remaining in the red.

As reported recently, Polygon announced integration with the yield optimization vaults on the Maker Network and the blockchain protocol referred to as the Matic Chain, tweeted that it will open a vault on Maker, and invested $50 million of tokens as agreed liquidity from the treasury. With the recent integration, it means that the protocol broadened its scope, vision, and transformation to become an ETH scaling aggregator and among others, this could see the protocol providing developers with L2 solutions. Also, this will be in addition to the PoS plasma Chain.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post