Coinbase-listed CELO coin surged 46%while BTC and ETH crashed and investors are holding on for dear life as we can see in our altcoin news today.

Today is a great day to be a Celo investor and the coin which is Coinbase-listed, increased by about 46% over the past day to $3.9 as per the CoinGecko metrics site and 60% in the past week alone. In the meantime, Bitcoin dropped 5.6% in the past 24 hours and 11% in the past week while ETH dropped by 3.9% and 19.1%. The big moves explain Celo’s good fortune as the crypto-friendly browser Opera added the stablecoins as well as CELO itself to the browser’s crypto wallet.

CELO and cUSD are now available in the @Opera wallet via @RampNetwork. Users can purchase and interact with these assets just like they can with other supported assets in the Opera wallet, including Bitcoin and Ethereum. https://t.co/l2KCasZLnt

— Celo (@CeloOrg) June 25, 2021

This is great news since Opera’s user count doesn’t even make it on to the same charts that Google Chrome and Apple Safari browsers do. Celo’s market cap is unclear but fairly small by a few estimations because Coinmarketcap said it has a market cap of $3.2 billion while Nomics reached the cuts to $860 million. The good news came a day ago from the institutional crypto trading platform Anchorage Digital which added more support for Celo Euro. The stablecoin was also listed on KuCoin and a day ago, Andreessen Horowitz A16z selected a subsidiary of Deutsche Telekom as a new Celo network validator.

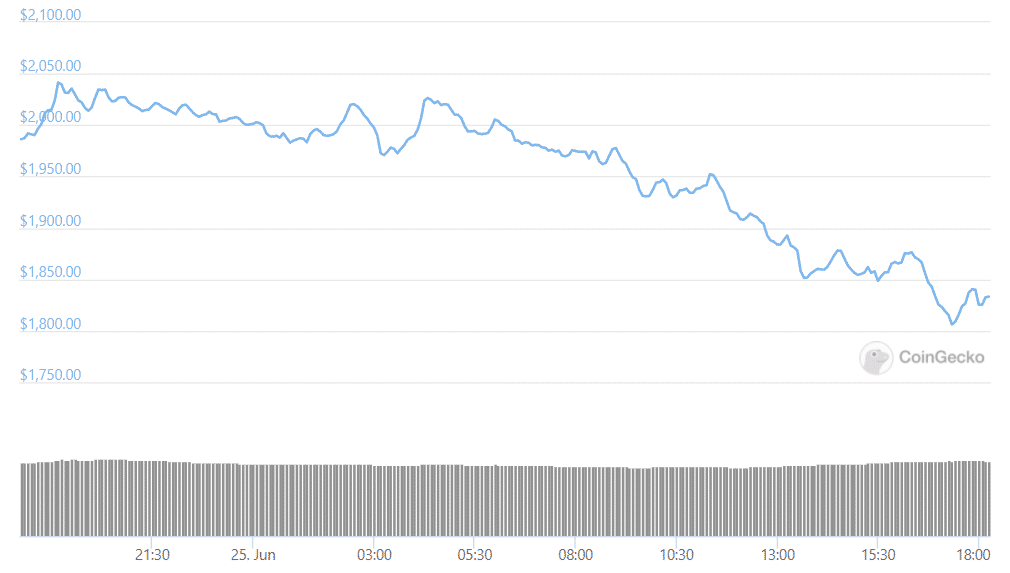

As reported earlier, $4 billion in options expire today which can oftentimes move prices as both cryptos started dropping already. Bitcoin, Ethereum, and the rest of the market took a hit over the past 24 hours. BTC and ETH are down by 7.6% and 8% respectively in the past day. Bitcoin and Ethereum options are derivatives contracts that provide the buyers with a right to buy the assets at a certain price in the future so when the options expire, the market can become volatile because there will be traders that will continue to hold or dump their crypto buys. This happened and already and the market crashed.

Bitcoin options represented 83,700 BTC and 685,000 in ETH that expired which is a record amount of options contracts expiring in one day for ETH and both assets started struggling which suggests that traders choose to sell. Ki-Young Ju who is the CEO of CryptoQuant added that he believed this was evidence of a bear market especially as ETH supply across all exchanges which was increasing and meaning that the investors are perhaps for a sell-off.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post