ETH crashed 15% against BTC in 2 days while Bitcoin jumped to a new high of $38,500 as we can see in the charts of our altcoin news today.

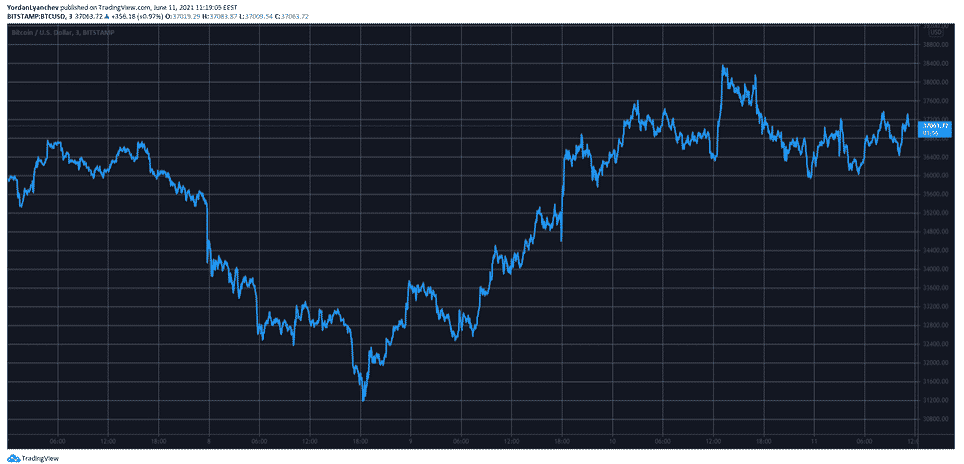

ETH is down by 15% in two days compared to Bitcoin and BTC continued with its recovery phase from the recent losses and went further to a six-day high at $38,500 before calming down. Most of the altcoins failed to produce more gains and Bitcoin’s market dominance jumped to 44%. after bottoming to $31,000 the main cryptocurrency started reclaiming its lost grounds and spiked by $3000 adding another chunk on Thursday and kept climbing higher in the past day.

As a result, BTC spiked to $38,500 a few hours ago and became the asset’s highest price tag since June 6th and reports suggested that India could have a change of heart on the crypto industry and will classify BTC as an asset class. As it happened during the previous breakout attempts, the bears took control and BTC dropped to $36,000. The situation reversed since then and BTC now stands above $37,000 once again.

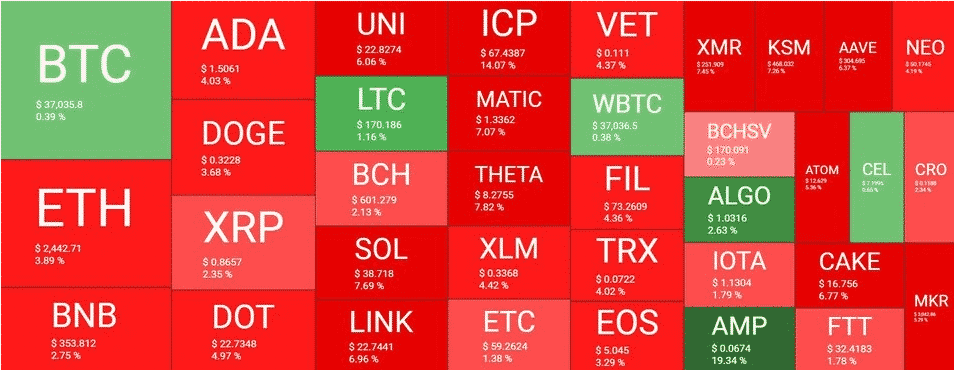

The crypto’s market cap just a few billion away from $700 billion and its market dominance is back at 44% as most alternative coins stalled or retraced over the past day. As mentioned above, most alternative coins lost some value in the past 24 hours as ETH crashed 15% against BTC and lost a considerable amount of value against the number one cryptocurrency. Binance Coin was riding high by hitting $380 but BNB got down by 3% in the past 24-hours to $350. The situation with Cardano, Ripple, Dogecoin, Polkadot, Uniswap, and bitcoin Cash is similar.

ADA got down by 4% to $1.5, DOGE still struggles at $0.32, XRP is below $0.9, DOT got down by 5%, and UNI by 6% to $23. The lower and mid-cap altcoins suffered in the past day as well with ICP losing 15% of the most and Synthetix 14% right after. THORChain lost 13% and Solana 10%. the cumulative market cap is down by $50 billion since a day ago.

As reported a few days ago, The cryptocurrency market dump $200 billion that was wiped out over the past 24hours. The total market capitalization declined by 11% in a fall from $1.74 trillion to a new low of $1.55 trillion during the Tuesday morning Asian trading sessions. The sell-off resulted in $200 billion being wiped out of digital assets and back into fiat and this is the lowest that the market has fallen since May 30 and it looks like there is more pain on the way.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post