The Bitcoin grayscale premium rebounds despite the recent crash and bitcoin trading below $35,000 as we can see more in our latest bitcoin news today.

BTC crashed by around 44% from its ATH of $64,899 signaling an end to the second biggest bull run that started in March 2020. Most analysts including the ones from BiotechValley Insights see the terrible technicals on the BTC market, noting that the flagship cryptocurrency could extend the ongoing decline until $20K. Glassnode Insights newsletter issued by Glassnode anticipated a BTC price recovery in the sessions ahead based on the indicators that serve as a metric to gauge institutional interest in the crypto.

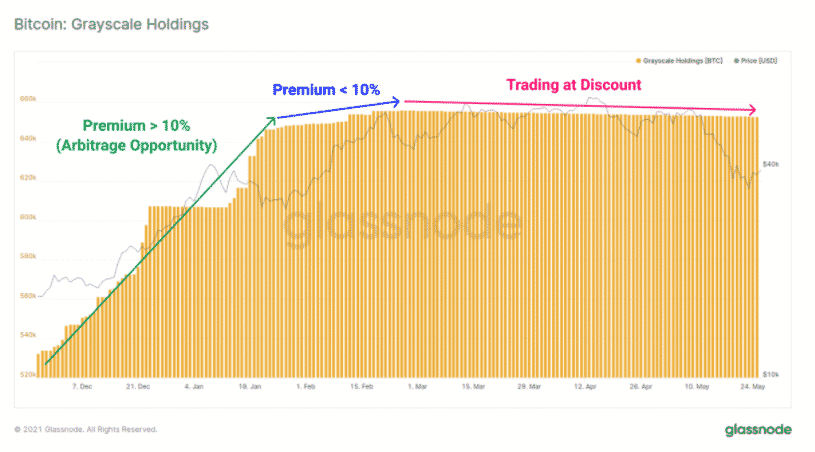

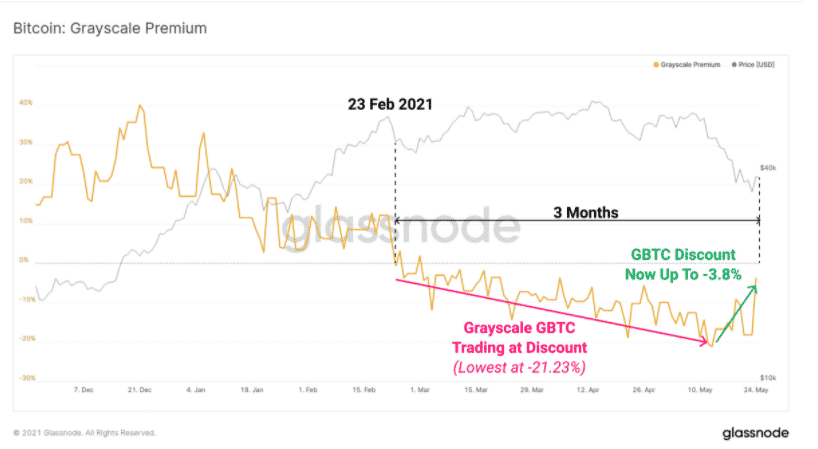

Dubbed as the Grayscale Premium, the metric follows all capital flow into the GBTC as the largest investment vehicle for institutional investors that are looking to gain more exposure in the market. The Bitcoin grayscale premium shows a higher BTC inflow into the trust and promotes GBTC to trade at a premium with respect to the BTC spot price so the lowering Grayscale Premium conveys a dropping BTC inflow with the fund attracting more than 50,000 BTC to its reserves in 2021 and the first half of February this year. GBTC traded at a 10-20% premium in the same period, showing a rising institutional interest.

The premium dropped below 10% in the first half of February and GBTC started trading to a discount. The same period saw the BTC/USD spot rate climbing from the low of 30,000s to $65,000 in April but then the GBTC premium flipped below zero. At the start of May, the Bitcoin market crashed and the GBTC premium reached a low of 21%. it also showed that institutional demand for BTC investment products declined. But after the crash, the Grayscale premium improved and the metric recovered to 3-8% suggesting that the institutional interest or the arbitrage trader convection increased along with the declining BTC spot prices.

The Canadian Purpose BTC ETF underwent a similar discounting trajectory and witnessed consistent capital inflow in April and May and outflows later as well as a sign of weakness in institutional demand as Glassnode noted:

“However, similar to GBTC, demand flows appear to be recovering meaningfully in following the price correction with inflows back on the rise as of late-May.”

The contrast between lower BTC spot rates and recovering prices conveyed that the institutions haven’t abandoned the market but it shows that the sell-off motivated investors to gain exposure to the Grayscale BTC trust and the Canadian Purpose Bitcoin ETF:

“Institutional products GBTC and the Purpose ETF are showing signs of recovery despite collapsing prices providing early signs of renewed institutional interest.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post