The GBTC Premium rebounds sharply as the crypto fund from Grayscale Bitcoin Trust traded at a negative premium to the net asset value as we are reading more in our latest BTC news today.

GBTC has been one of the biggest publicly traded crypto funds on the market and it saw its high premium drop as competition weighed in. In the past, the institutional investors had to accept the high management fees of the GBTC and punished redemption periods because of no other alternatives. But now with the new BTC exchange-traded funds entering the market in Canada, plenty of investment companies are following suit by filing their own in the USA. The three available BTC ETFs in Canada- CI Galaxy, Evolve, and Purpose, offer expense ratios of 1%, 0.75%, and 0.40% compared to the one that Grayscale offers of 2%.

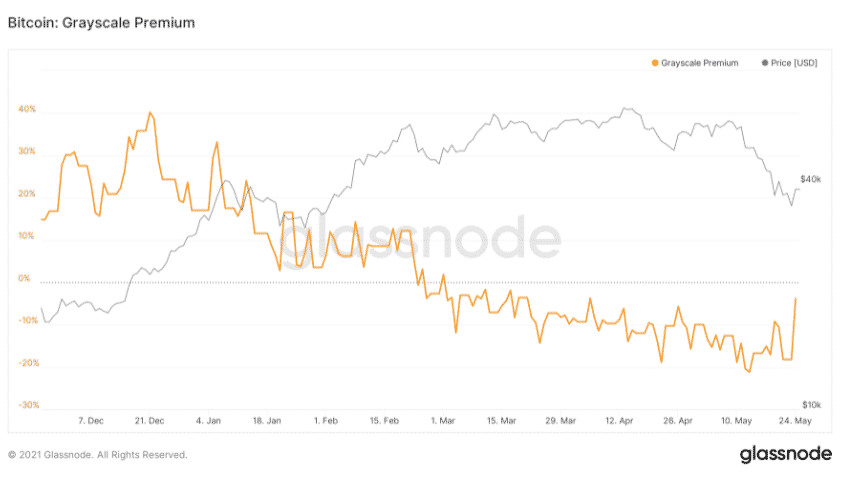

According to the data from Glassnode, Grayscale bitcoin’s trust premium to NAV dropped to -21.73% on May 13 with its lowest point in fund history. GBTC was trading at a premium of 30% at the start of the year with Canadian competitors taking up the market share and US. The ETFs are on the cusp of approval and the inflows were drying up and leaving the premium of the fund at a huge discount.

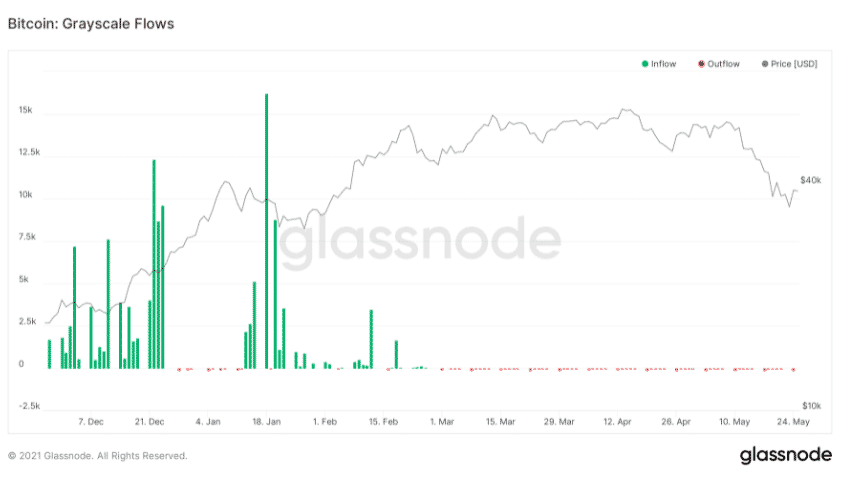

Grayscale announced the plans to covert the GBTC fund structure to an ETF while hoping to remain competitive and the news sent the premium higher. For now, Grayscale’s six-month lock-up periods expired and the fund’s premium to NAV increased to -3.87%. According to the GBTC vesting schedule, most of the institutional investors will have their expiries complete by the end of July. This will allow the locked-up investors to sell their positions and to relieve the funds from the recent downward pressure. The Glassnode data shows that the last inflow was on January 18 for 16,243 BTC which is about $6 billion at the price of BTC at that time. With no outflows left and an ETF transformation on the horizon, the GBTC premium rebounds and could return to positive soon.

As previously reported, Grayscale filed its third Form 10 with the United States Securities and Exchange Commission to convert its investment fund into an SEC-reporting company. Grayscale filed to make the Digital Large Cap Fund an SEC reporting company and if approved, the GDLC will be obliged to file quarterly and annual financial reports in addition to mandated documents, stated in the exchange act.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post